How to Trade in Forex

Knowing what forex trading is and how the forex market work is not enough to start trading. In order to learn how to trade in forex, beginners need to learn about the forex platforms, strategies and trade process.

Here's a quick look at what you'll read

- Pick a currency pair for trading.

- Explore the Forex market.

- Learn about the quote.

- Select your position

Pip is the smallest price movement a currency rate can make based on the foreign exchange market pattern.

Foreign exchange is generally traded in particular amounts, known as lots or currency units.

This process allows traders to get money to acquire a larger exposure with a relatively small deposit.

- The political landscape

- Inflation rate

- Government Debt

- Demand for imports and exports

- Economic statistics

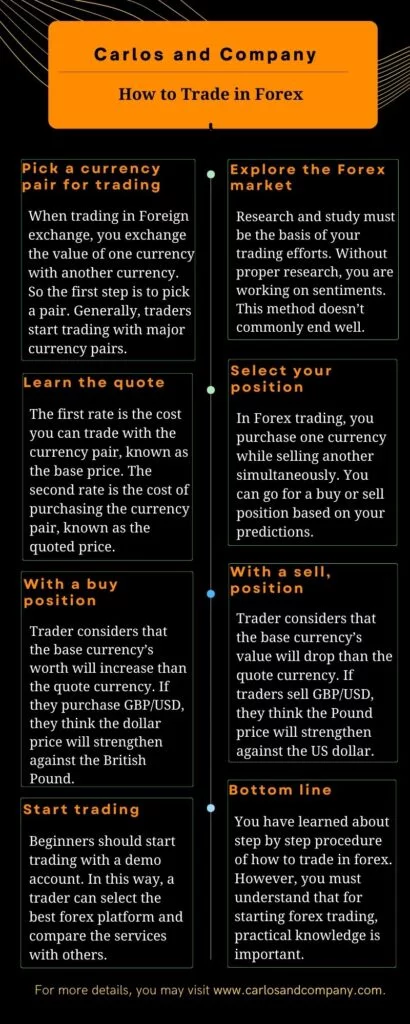

How to Forex trade for beginners

Here is a step-by-step procedure for beginners to start trading in currencies.

Pick a currency pair for trading.

When trading in Foreign exchange, you exchange the value of one currency with another currency. In simple words, you will purchase one currency while selling another currency simultaneously—that’s why you will always trade the currencies in a pair.

Various new traders and beginners will start trading with most generally given pairs of major currencies, but you can trade in any currency if you have lots of money in your bank account.

Explore the Forex market.

Research and study must be the basis of your trading efforts. You can also explore trading with the help of a free or paid forex trading course. Without proper research, you are working on sentiments. This method doesn’t commonly end well. When first studying, you will see a whole worth of forex resources that may appear huge initially.

But if you study a specific currency pair, you will see helpful resources that jump out. It would help to examine the current and historical charts regularly, observe the news for financial information, study indicators, use technical and fundamental analysis and formulate forex trading strategies.

Learn the quote

The most important step of how to trade in Forex is to learn to read currency quotes. The first-rate is the cost you can trade with the currency pair, known as the base price. The second rate is the cost of purchasing the currency pair, known as the quoted price.

The difference between the first and the second rate is called the spread. It is the charge a broker charges for making the trade. Spreads will differ among the forex brokers. They deliver competitive spreads on the broad range of offered currency pairs.

Select your position

If you have traded in stocks, currency, or other financial products, you understand that you could often guess the one rule of the market.

Forex trading is quite different because you purchase one currency while selling another simultaneously. Then, You can assume the trends in the market.

With a buy position:- Trader considers that the base currency’s worth will increase than the quote currency. If they purchase GBP/USD, they think the dollar price will strengthen against the British Pound. In simple words, they believe the US dollar is bullish, and the British Pound is bearish.

With a sell, position:-Trader consider that the base currency’s value will drop than the quote currency. If traders sell GBP/USD, they think the Pound price will strengthen against the US dollar. In simple words, they believe the US dollar is bearish and the GBP is bullish.

For a better understanding of the Buy and Sell position and how traders make currency trading strategies, let us look at a Forex trading example.

JOINING A BUY POSITION

The current price of EUR/USD is 1.33820/840. Traders consider the British pound bullish, so you select to join a buy position for one lot of the GBP/USD.

They choose to join a buy position for one lot of GBP/USD.., so they decide to enter a buy position for one of the GBP/USD. Because you are purchasing, your trade is joined at 1.33840.

JOINING A SELL POSITION

Suppose that you consider the British pound is bearish.

They choose to join a sell position for one lot of GBP/USD. Your trade enters at the cost of 1.338 because you are selling.

Forex Market Terminologies

What is a "Pip"?

Pip is a “percentage in point” or “price interest point.” It is the smallest price movement that a currency rate can make based on the foreign exchange market pattern, and it is an essential unit of measurement in forex trading.

Traders utilize the pips to measure the movements of prices in currencies. Defining the multiple pips in a specific price movement is a detailed process, even though it depends on the traded forex pairs.

For example, if the GBP/USD price moves from 1.20170 to 1.20180, that 0.0001 USD increase in value denotes one pip.

A pip denotes a one-digit movement in the fourth decimal for most primary currency pairs.

What is a "Lot"?

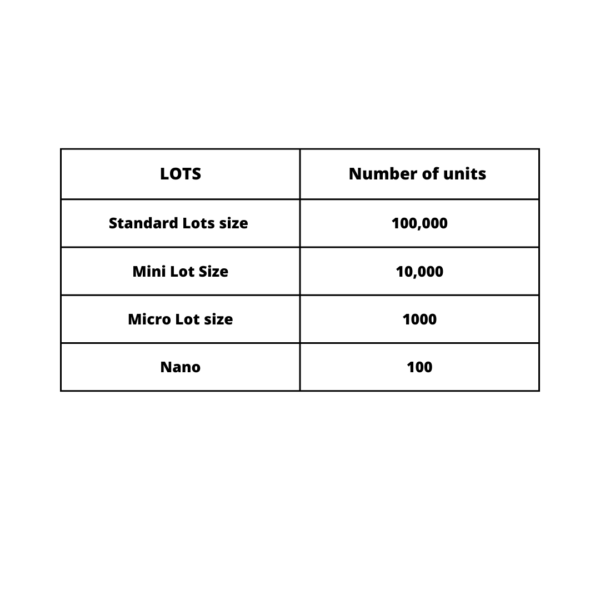

Foreign exchange is generally traded in particular amounts, known as lots, or specifies how many currency units you buy or sell.

The standard lot size is 100,000 units of currency, and now there are also micro, mini, and nano lot sizes that are 1000, 10000, and 100 units.

Typically small investors don’t have access to large amounts of money, so many forex brokers enable their clients to trade on leverage.

Leverage in forex is a process that allows traders to get an amount of money to acquire a larger exposure to the foreign exchange market with a relatively small deposit. It provides the possibility for traders to elaborate on possible profits and losses.

Major currency pairs

Theoretically, you can trade any currency in the world for any other currency, which refers to the type of forex pair you could trade, which is extensive. You can even imagine the price of the Nigerian Naira versus the Armenian Dram (NGN/AMD) if you find a broker ready to trade that currency pair.

If you noted, all the currencies are traded with the US dollar, which represents the single most traded currency globally.

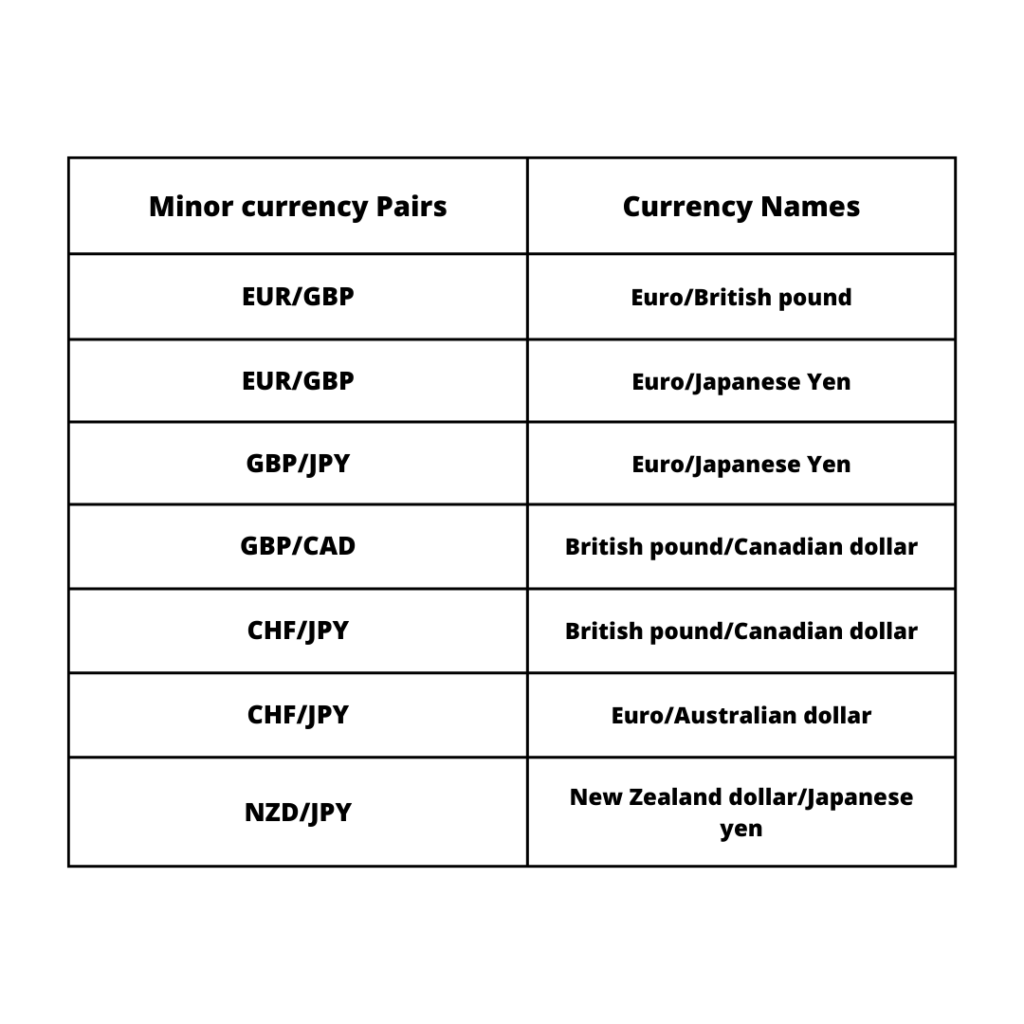

Minor and exotic pairs

Minor currency pairs are those pairs that are traded less often. This pair includes the primary currency apart from the US dollar. They are also known as cross-currency pairs. The most popular trading currency involves the British Pound, Japanese Yen, and Euro.

Some forex dealers may also guide to exotic pairs. These currencies typically consist of one primary currency against another from a short economy. For example, USD/PLN, GBP/JPY.

What factors affect the forex market?

Currency trading is not difficult if you have a basic idea about the fluctuations in forex exchange.

Over time, it has been discovered that specific factors influence the different types of foreign exchange market. Here are the 5 critical factors that may affect forex trading

- The political landscape

- Inflation rate

- Government Debt

- Demand for imports and exports

- Economic statistics – Manufacturing data, Growth Figures and Employment and Unemployment levels.

Final words

You have learned about all the important aspects of how to trade in forex. However, you must understand for starting forex trading, practical knowledge is important.

Beginners should start trading with a demo account. In this way, a trader can select the best forex trading platform or signal providers and compare the services with others. A trader can also check his ability to make a profit in the market with demo trades.