Fear & Greed in Trading: How to Overcome Emotional Biases for Better Results

What does it take to be a successful trader?

You must be thinking about trading strategy, risk management, huge capital, or analytical skills.

Well, all these things are secondary. The first thing you need to succeed is the right trading psychology.

Traders’ mindset is crucial. It will not only decide the trading outcome, but it will also determine how long a trader will survive in the market.

Developing a positive psychology is the key to success in the trading world. However there are many things that stop you from embarrassing the right psychology. This article will discuss these psychological enemies and how to fight with them and win the trading battle.

What is psychology in trading?

Trading psychology refers to the mindset or mental state of a trader or investor while buying or selling financial assets. It refers to how traders react to both positive and negative trade outcomes.

Trading is a mind game. It involved the risk of losing money and the desire to make the most money. And, for that a trader spends hours in identifying the right opportunity. Thus a trader’s emotional state plays a crucial role in order to make an informed decision.

Here's a quick look at what you'll read

Trading psychology refers to the mindset or mental state of a trader or investor while buying or selling financial assets. It refers to how traders react to both positive and negative trade outcomes.

Develop emotional control, follow a structured trading plan, maintain a risk-management strategy, and journal your trades to improve decision-making.

Identify emotional triggers, practice discipline, use stop losses, trade with a plan, and focus on long-term consistency instead of short-term wins.

Build mental resilience through mindfulness, backtesting strategies, sticking to rules, and learning from both wins and losses without emotional bias.

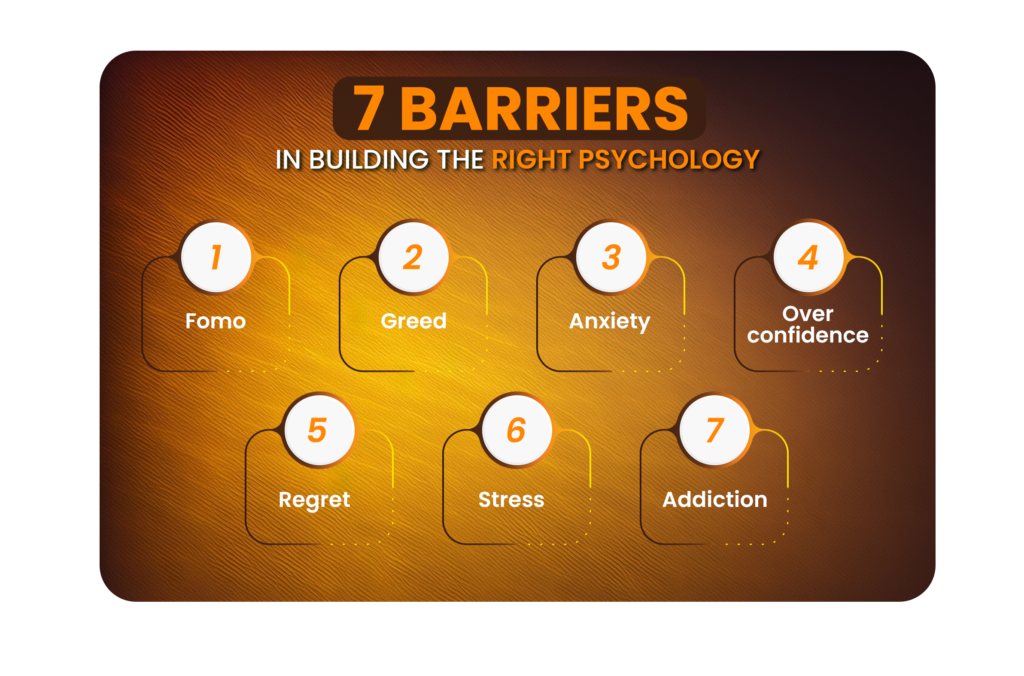

7 Barriers to Developing the Right Trading Psychology

The psychology of trading is affected by your emotions, sentiments, and mood. Developing a positive trading mindset may look easy by reading books or theories, but it’s actually not. Thus, to help you out, let us study what is stopping you in the process:

FOMO

FOMO stands for fear of missing out, and it is your biggest enemy in building the ideal mental state. Trading is all about making the right decision to achieve the desired results.

The real problem arises when traders make impulsive decisions without doing proper analysis due to FOMO. In such cases, instead of making a profit, they will start losing money in the market.

Never place a trade in a hurry or thinking that everyone is doing so. If you lose one opportunity, the next opportunity will knock on your door. So don’t run behind every opportunity, and wait for the right one.

Greed

The ultimate aim of every person entering the financial trading world is to make money and there is nothing wrong with it. The problem starts when you want to make a huge amount of money too quickly.

Success is not overnight; it takes knowledge, effort, skills, hard work, and many other things to make money in the trading market. If you are thinking that without learning or making an effort, you will earn a huge amount in the market, then you are wrong.

The hope of becoming a millionaire in one night is a huge barrier to embracing good trading psychology in forex or any other market. Even experienced trader fails to keep greed out of their trade.

Many traders, even after making a decent profit, continue to keep their position with the zeal to earn more and more. In such cases, instead of making more, they lose what they have earned. So don’t let your greed ruin your trading journey.

Anxiety

Losing your hard-earned money is painful, and it affects your mind. However, you should understand one thing in the treating world. A potential risk is involved. And with the chances of making money, the potential of losing money is also there.

However, handling losses is among the most difficult things for traders. Taking losses to your mind results in impulsive decision-making, revenge, and overtrading.

If you experience panic after losing money, then keep your calm. It is better if you take a break, exercise, or relax for some time. In addition, avoid trading during such scenarios. Once you get back to your normal state, find out the reasons for losses and then place a trade with improvised strategy.

Overconfidence

Overconfidence is common, especially when you have just started trading and made a few profitable trades. Usually, in such cases, traders start thinking that they are the best, and nobody can match their strategy.

However, that’s when the whole game really begins. Positive trading psychology not only deals with how you take losses, but it also deals with how you take profit.

Overconfidence leads to aggression in trading, and the probability of making illogical decisions is higher in such cases. So don’t let your win affect your mind, and treat both profits and losses with a calm mind.

Regret

People have regrets in life, so obviously, having regrets in trading is also obvious. But when money is involved, the regret is bigger. When traders suffer losses, it arises a feeling of regret in their minds. Most traders at this stage feel that they’re doing something wrong or that the market is not for the financial market.

In such cases, traders start doubting themselves and no longer believe in their trading strategies. Having no hope left, many traders quit at this stage. However, losses are the biggest teacher in trading, so don’t regret and find out what went wrong and work on yourself.

Stress

Trading is a stressful career with unstable returns, ups and downs. It takes sleepless nights, continuous efforts and learning to be successful in the market.

So basically, it affects you a lot, especially when you are losing; losses take over your mind. And how can you make the right trading decision with a stressful mind?

Stress is harmful, especially for high-frequency traders like scalpers and day traders. Thus to develop the right day trading psychology, one should know how to tackle stress.

Addiction

Trading has the potential to help you make a good amount that too in a short time. So, most traders started treating it like gambling and got addicted to the market.

Such traders spend hours watching trading charts and doing technical analysis. They want to take advantage of every opportunity in the market, so they start placing trades frequently.

Many traders make huge losses, quit trading and then return back to the market and lose again. This process keeps continuing, and all this happens due to addiction. However, the financial market is not a place for gamblers, so stop treating it like gambling.

4 Weapons to Fight Trading Psychology Enemies

We have discussed the enemies that are ruining traders’mindset. However, the main question is how you can fight these enemies and develop the ideal trading mindset. Well, you just need the below-mentioned elements to master trading psychology:

FOMC

The United States has the strongest economy, and the US dollar is the strongest currency. So, the financial health of the US has an impact on the entire financial market.

The Federal Open Market Committee (FOMC) consists of Twelve Authorities from the USA, including the FED chairman. These people meet eight times a year to discuss the US financial condition, monetary policy, interest rates, and other important aspects.

Forex traders keep an eye on these meetings and speeches of its members to predict the currency market. FOMC meetings and press releases create huge volatility, which makes trading quite risky.

Patience

Patience is the rarest in the financial market. Novice traders enter the market with the mindset of changing their entire lifestyle quickly. And most of them seriously lack patience.

Overtrading, FOMO, anxiety, and stress are the result of a lack of patience. Traders generally think trading is more about execution and less about waiting. However, it’s exactly the opposite; trading is more about waiting and less about execution.

Trading is a game of quality vs quantity. It’s not about how many trades you place; it’s about how many of them actually worked. Embrace patience and wait for the right time and opportunity.

Discipline

Money is the most important resource in one’s life. Thus you need to be very vigilant in planning your finance and investment. Trading without any discipline is just playing with your hard-earned money.

Discipline is the solution to most of your trading problems. Always trade with a strategy, develop trading rules and follow them, don’t take excessive risk, and prepare trading journal. All of these will help you integrate a disciplined trading approach that ultimately develops the proper trading psychology.

Consistency

Novice traders aim for huge profits, and pro traders aim for consistency. Making a big profit once in a while is not a big thing. However, consistently earning a decent profit is for sure, and most traders fail at this stage.

Profit and loss are part and parcel of the trading game. Some days you win, and some days you lose. However, problems arise when losses exceed the profit amount. A trader should always aim to keep the profit more than the losses, and that’s what consistency stands for.

Confidence

There is a fine line between confidence and overconfidence. A trader should always maintain that line. During your trading journey, many times you feel like quitting and that’s where confidence can help you.

Even when you are losing money in the market, then also the ‘I can do it’ attitude is necessary. Otherwise, you may end up quitting your journey. So trust your plan, strategy, and analysis method and take steps to make it better.

Conclusion

Trading is the battle against your emotions; once you win that war, then profit-making becomes easy. You may find developing an ideal trading mindset difficult, however it is not actually.

Knowledge, patience, discipline, consistency, and confidence are the pillars of building the right trading mindset. So, work on them and see the results.

Also, one thing to conclude is that the ultimate reason for a poor mindset is excessive losses. With Carlos and company’s valuable trade alerts, you can make maximum money while keeping the losses in check. So give us a try and see the results.