What Is Financial Trading?

Financial trading is one of the popular ways to make money in modern times. However, trading in the financial market requires knowledge, skills, and strategies. Therefore it is important to have detailed information about what is financial trading.

Here's a quick look at what you'll read

Financial trading is the activity of buying and selling financial products. It is brought out in two methods:- through “over the counter”(OTC) or exchanges.

- Stock Market

- Bond Market

- Commodities Market

- Derivatives Market

- Forex Market

There are two kinds of analysis:-

- Fundamental analysis

- Technical analysis

There are three things you need to do when you start financial trading.

1. Open a trading account

2. Find an Opportunity

3. Open and analyze your first trade

What is trading in the financial market?

Financial trading is the activity of buying and selling financial products. It is brought out in two methods:- through “over the counter”(OTC) or exchanges.

Trading is a well-organized market platform for purchasing and selling certain instruments. For example, you can exchange US shares with another share on NYSE (New York Stock Exchange).

When you trade in the Stock Market Exchange over the counter market, the trade creates directly between two groups. Let us have a look at the Financial Trading example.

Suppose a car company is in the news these days for making bulletproof cars for commoners and is available at the price of a normal car. So a trader will buy that particular stock to get the advantage of this news and make a profit.

Difference between the OTC and Exchange Market in Financial Trading

What type of financial markets can you trade?

There are numerous financial markets, and at least one has its market in each country, even though they differ in size. Some are small markets, and others are known internationally, such as the NYSE(Newyork Stock Exchange Market), which exchanges daily for trillions of dollars. Here are various types of financial trading-

Stock Market

The stock market exchanges the shares of companies’ ownerships. Every share has come with its price, and the investor earns money by selling those shares that perform well in the market.

It is easy to purchase the shares. But the real challenge is picking the right shares that will make a profit for the investors. There are multiple indices that the investor can utilize to observe how the share market is performing, such as Nifty50 and the S&P 500.

When stocks are purchased at a lower price and sold at a higher price, the investor earns profit from the market, and in the opposite condition, they lose money.

Bond Market

The bond market provides options to the companies and government to secure money to fund a project or investment.

The investors purchase bonds from a specific company, and the company returns the share of the bonds within a consented period plus interest.

Commodities Market

In the commodities market, investors purchase and sell various commodities such as oil, meat, corn, comex products, etc. A particular market is made for such items because their cost is unexpected.

There is a future commodities market in which the price of commodities to be paid at a given future time is already placed and closed today.

Derivatives Market

The derivative includes contracts based on the traded asset market value. The future things noted above exemplify a derivative in the commodities market.

Forex Market

It is the largest financial market in the world where trillions of dollars are traded on a daily basis. FX market is the market where buying and selling of currencies take place.

In Forex trading, traders, based on their predictions, invest in currency pairs and profit from currency fluctuations.

Many financial trading companies provide access to these markets and provide financial trading courses to help traders invest their money in the market.

Who Trades in the Financial Market?

Millions of institutions, individuals, companies, and even governments are trading simultaneously. But what is a trader or investor? A trader is an individual who purchases and sells financial products or instruments intending to create a profit.

Some investors adhere to a specific instrument or asset class, while others have various portfolios. Some do lots of research before putting a trade, while others observe the trends and read the candlesticks charts.

But one thing is common in all traders -they all take the risk. Risk is a critical concept for all kinds of financial trading. There is no issue with what instruments are being exchanged or traded or where the trade carries, and balancing possible profit is the key to a successful trading strategy against risk.

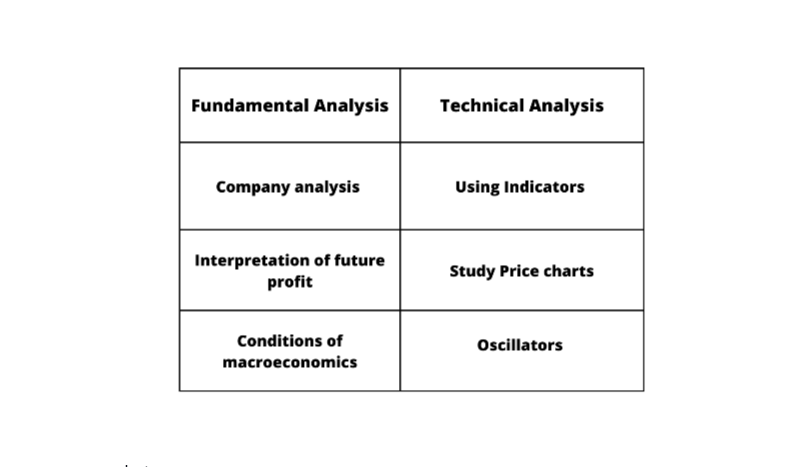

Also, you need to do a complete study of the market that you like to trade. There are two kinds of analysis:-

Fundamental Analysis:-

Fundamental analysis involves all the company elements that can affect the company’s share price in the future. These involve management techniques, financial statements such as cash flow statement, Balance sheet, and more.

Technical Analysis:-

In technical analysis, we examine financial charts and utilize financial indicators to determine potential future trends.

What is trading and investing?

People commonly refer to trading and investing as the same thing, but they differ. Financial trading and investing lie in creating a profit, and even you can take ownership of the shares. Traders profit from purchasing shares at low prices, selling them at high prices, and buying at low prices or often in the short or medium term.

While Investors will also be earning a profit from buying shares at low prices and selling them at high prices but usually in the long term, they may also seek to receive income in the dividend form.

How you start financial trading

There are three things you need to do when you start financial trading.

Open a trading account.

You can apply online for a CFD trading account with a financial trading company. Once the platform verifies your identity and authorizes your account, you can add funds through PayPal, a bank debit card, or a bank transfer.

Find an Opportunity

You can find the opportunity by searching over 17000 financial trading markets and using multiple tools and resources to see your first trade. Then you select which market you must trade based on risk-hunger and experience.

All financial trading includes risk, so you must use a risk management strategy to protect yourself against huge losses.

Open and analyze your first trade.

Once you have finished these steps, you can determine when to participate in the market. You can assume both growing and declining financial markets when you trade on CFD.

If you feel that the price will rise, you will open a place to “buy; you will open a place to “buy.” If you think the price will fall, you will open a place to “sell.”

Your trading decision must be based on your market analysis and trading strategy. You can exchange on platforms (Mobile and Web) such as IG, Upstocks, or Ava trade.

Final words

After mentioning the various important aspects of what is financial trading in the above articles, we summarize that financial trading is about buying and selling financial assets.

You can trade on assets or shares “over the counter.” Financial trading is brought out through an OTC or financial exchange. Various individuals, companies, and even governments also trade in financial markets.

One important thing to remember is that before making a trading decision, properly study the market and analyze the charts carefully.