Sell Orders in Forex Explained Guide to Profitable Short Trades

Forex is the largest financial market, and traders can take advantage of both rising and falling prices. However, even after that, too much importance is given to opening long positions.

Traders can even earn a significant amount by opening short positions but with the right execution. Being a reputable signals provider, Carlos and Company understand the importance of sell order management.

So, in this blog, we will master sell orders forex execution with examples and practical tips for placing trades accordingly.

What are Sell Orders in Forex?

A sell order defines a way a trader opens or closes a short position in a currency pair. Traders can enter and exit positions in different ways, and these ways are known as orders.

An order can be for buying or selling a currency pair. Let us take an example of an e-commerce platform. When you want to buy something, you place an order, and when you want to sell, you list that order on the platform.

Similarly, on a forex trading platform, when you want to buy a currency pair, you place a buy order. Meanwhile, when you want to sell a currency pair, you place a sell order.

Here's a quick look at what you'll read

A sell order is an instruction to sell a currency pair, expecting the price to drop for a profit.

It means selling 0.01 lot (1 micro lot or 1,000 units) of a currency pair.

A buy order is placed when expecting prices to rise, while a sell order is placed when expecting prices to fall.

A market sell order executes instantly at the best available bid price.

A sell limit order is used for opening a position at the price level above the current market price. Meanwhile, a sell stop order is used for opening a position at the price level below the current market price

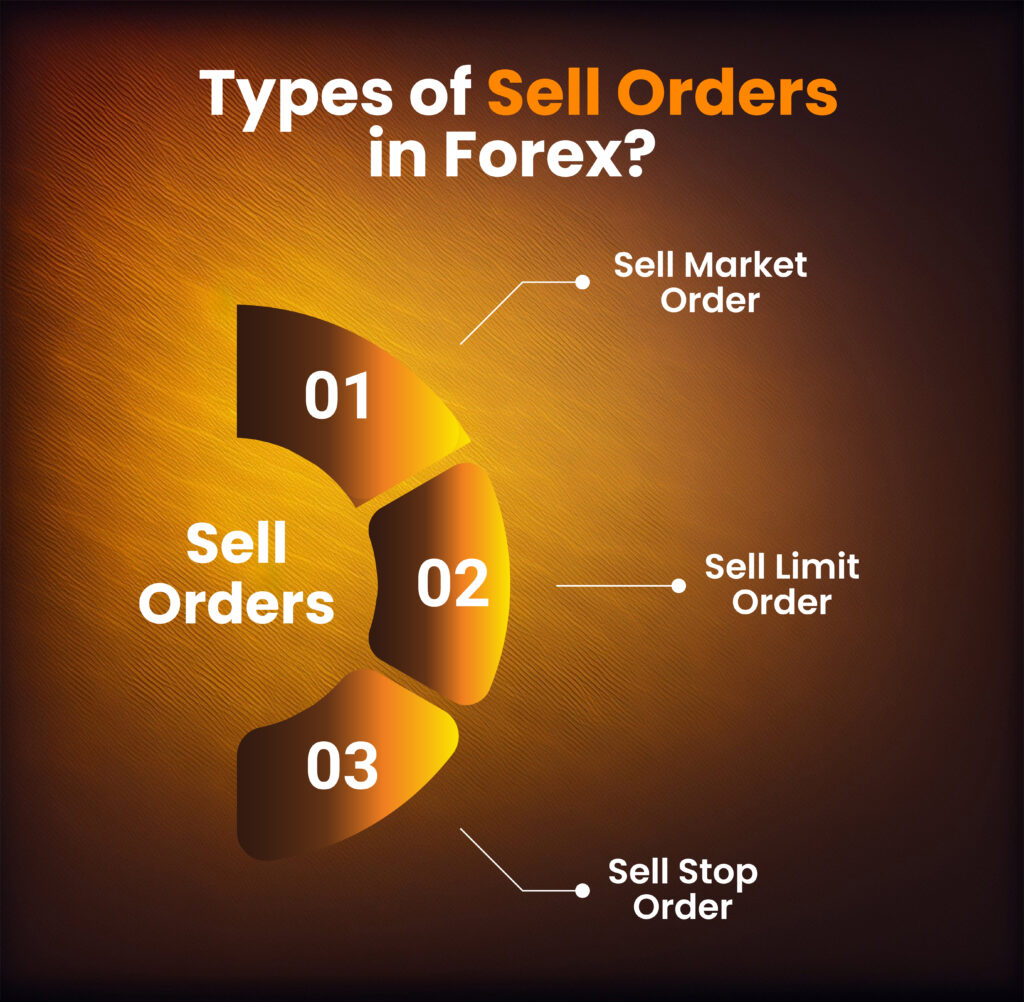

Types of Sell Orders in Forex

A trader can buy or sell currency pairs in the market using different forex order types. However, here we will specifically discuss the sell orders forex executions with examples, pros and cons. It will help you in understanding the difference and select the right order type:

Sell Market Order

It is the most common type of order that deals with selling a currency pair at a current market price. Basically, you can use a sell market order to immediately sell a currency pair at the best available price.

Suppose a trader thinks that the US Dollar is all set to fall against the Japanese Yen. So, the trader decided to open a sell position in USD/JPY immediately.

The trader opened the broker platform and placed a sell market order when the price was trending around 153.49. In this case, if the price rises, the trader will lose money, and if it falls, then the trader will earn money.

Pros

- Simplest and easy to execute forex order

- Best for immediate execution.

Cons

- Smooth executions depend on high market liquidity.

- Unexpected events and news can significantly affect the execution of trade orders.

Sell Limit Order

A Sell limit is a type of pending order that is used to sell a currency pair at a limit price, or better. Under this, the order will execute only when the price reaches the specified level or better.

Let us have a look at the sell limit example. Suppose the price of GBP/USD is trending at 1.2810. A trader wants to open a sell position when the price reaches 1.2850.

Thus, in this case, the trader can wait in front of the monitor till the price reaches the desired level or use the sell limit order. If the trader uses the sell limit order, the trade will automatically trigger when the price reaches 1.2850 or above.

Pros

- Traders enjoy control over Prices.

- Trade automation saves traders time.

- Best to use during price reversals.

Cons

- The order will only execute if the price reaches the limit level. So, there is no guarantee of execution.

- Smooth execution depends on liquidity.

Sell Stop Order

It is amongst the most popular sell orders forex type. Many traders confuse sell stop and limit orders with each other. Both the orders are pending orders but are quite different. A sell-stop order is used to open a sell position when a price reaches a specified level below the currency price.

Under this, the order will automatically execute when the price falls to the specified level. Meanwhile, the sell limit order is used when a trader wants to open a sell position above the current price.

A sell limit order is generally used when there is a potential for price reversal, Meanwhile, a sell stop order is used when the price is expected to fall further. Let us look at an example to better understand this forex order.

Suppose a trader can see a short selling opportunity in the EUR/USD. The current exchange rate for the pair was around 1.06. As per the trader’s analysis, if the price reaches 1.02, then it continues to fall further. In this case, the trader can place a sell-stop order, so the trade will execute automatically when the price reaches that level.

Pros

- Best to take advantage of the downtrend.

- Competitive trading fees

Cons

- No guaranteed trade entry. If the price does not fall to or below the desired level, the order will not execute.

- Price reversal can affect the entire trade execution.

Tips for effective Sell Orders Forex Execution

Effective order execution is an art and learning it will enhance the chances of profitability. Here are some exclusives that help you master order execution:

Practice Demo Trading

The best way to learn sell orders forex executions is demo trading. Before trading with real money, practice different forex orders in demo accounts. It will help you identify the best fit for your needs and test the brokers.

Watch Market Conditions

Market Volatility and Liquidity are the two factors that have a significant impact on your orders. Low liquidity results in gaps, slippage, and delays in order execution. Thus, keep track of these elements to place trade properly.

Track News and Economic Events

Fundamental factors like major financial news, announcements, wars, diplomatic ties, and economic event releases have the power to change the entire market. In such cases, your order may never be executed or executed before the time.

Use Risk Management Tools

Irrespective of the orders you are using, make sure to set stop loss and take profit levels. Stop-loss orders allow you to close a trade when the trade exceeds your loss limit. Meanwhile, take profit allows you to lock the profit when you achieve the desired outcome. Using these tools enables you to minimize your losses and increase your overall profit.

Timely Analyze Your Trades

You can improve only when you know where you are lacking. Thus, timely analysis is a must. Keep track of all your trades, including order type, profit, loss, currency pair, risk-to-reward ratio, and other criteria. Analyze them to know the strengths and weaknesses of your order management plan and make changes accordingly.

Wrapping Up

The most successful forex traders in the market have made money by opening short-selling positions in a currency pair. Forex provides numerous opportunities to make money in the falling market.

However, most forex traders avoid opening short positions. This is because making money in the bearish market is more complex than in the bullish market. But when you master sell orders forex executions, then the outcome is much better.

Being a reputable forex signal provider, Carlos and Company know the importance of order management. We provide our signals with proper execution guidelines; you just need to follow them and place the trade. So if you are struggling in placing a trading order then you can contact us now.