Cash Flow Statement Analysis

Cash flow statement analysis is very important for a company. It helps to determine the company’s financial health. It helps the investor identify whether to invest in a company or not.

Here's a quick look at what you'll read

A cash flow statement is financial information that delivers complete details about all the company’s cash inflows that it receives from its continuing processes and external investment references.

- Accrual Accounting

- Cash Accounting

- Cash flows from Operations.

- Cash flows from Investing.

- Cash flow from financing

A cash flow is a digit in the statements, known as net cash given through the operation movements or net cash flow. If net cash is positive, then it is good for the company’s financial health, and if not, then vice versa.

What is a Cash Flow statement?

A cash flow statement is financial information that delivers complete details about all the company’s cash inflows that it receives from its continuing processes and external investment references.

Cash flow includes all the outflows the company pays for its business activities and investments during a given period.

The figures on its statement show how a business spends its money means “cash outflows”, and from where the company receives its money means “cash inflows.”

These statements involve cash flows from operating, financing, and investing activities that helps investors to form their trading strategies. This blog article will describe the cash flow statement and its analysis.

Why is Cash flow statement Analysis and interpretation important for a company?

The cash flow statement helps the investor in trading stocks and indices. There are two accounting states decide on cash movement within a company’s financial statement. They are accrual accounting and cash accounting.

Accrual Accounting

Various public associations employ accrual accounting. It is a method of accounting where the income is declared by revenue when earned instead of the company acquiring payment.

When it is incurred, the expenses are noted, although no cash payments have been completed. For example, if a company registers a sale, then the revenue determines on the income report, but the company may not obtain cash until later.

From an accounting point of view, the company would create a profit and settle all income taxes on the income reports. Yet no cash needs to exchange.

Also, the transaction would probably be a cash outflow initially from it values the money for the company to purchase the inventory and make a product to be sold.

It is typical for the companies to grow by 30,60, and it takes 90 days for clients to deliver the invoice. The sale would be an account receivable with no effect on cash until organized.

Cash Accounting

The deal would be an account receivable without effect on money until organized. Cash accounting is a method in which income receipts are registered when received, and expenses are recorded when they are paid.

In other words, revenues are recorded when cash or income is received, and expenses are recorded when cash or income is paid.

A company’s profits show as a total income on the income reports. For the company, income is the bottom line. Yet net income doesn’t imply that it collected all the receivables from its clients.

The company might be promising from an accounting viewpoint, but if receivables are uncollected, the business can drive into financial issues.

Also, profitable companies can fail to manage their cash flows sufficiently; as a result it will have an effect on their balance sheet , the cash flow statement report is essential for investors and analysts.

Categories of Cash flow statement

These statements are mentioned into three related to a specific element- operations, investing, and financing of action of company business. Here is the standard structure of a cash flow statement method.

Cash flow from operations

This category states cash payment from the income statement initially recorded on an accrual basis. Some items in this category are accounts receivables, accounts payable, and income tax payable.

If the customer pays a receivable, it would be registered in cash from the operation category. The current assets’ and liabilities’ fluctuations always record cash flow from operations.

Certain cash flow statement analysis ratios, including coverage ratio, margin ratio, etc., can be used to analyze operating cash flow.

Cash flows from Investing

All the sales and purchases of long-term investments like fixed assets, property, plants, and equipment are records in this category. This section also includes furniture, building, and land purchases.

Generally, Financing the transaction develops the capital expenditures for plant, property and equipment, business assets, and acquisition of investment securities. Cash inflows reach from selling securities, business, and asset sales.

Investors generally observe the capital expenditures utilized for the company’s maintenance and physical assets that help the company’s operation and competitiveness. In short, Investors can watch how a business is investing in itself.

Cash flow from financing

In cash flow from financing, the debt and equity of the transactions are recorded in this category. Any cash flows with the repurchase things like dividend amount, sale of stocks, and the bond would assume the cash flow from financing activities.

The cash received from taking out of a loan or cash utilized to settle the long-term debt would register in this category. For investors who like companies that pay dividends, this category is essential. Since it displays the cash dividends and not the net income utilized to give dividends to shareholders.

Cash Flow Statement Analysis

A cash flow defines as the digit that occurs in the statements, known as net cash given through the operation movements or net cash flow. Yet there is not always an acknowledged purpose.

For example, various financial professionals believe a company’s cash flow plus its net income, depreciation, and non-cash charges like amortization. The shortcut can be incorrect while reaching net operating cash flow, and investors should be tied to the net operating cash flow figure.

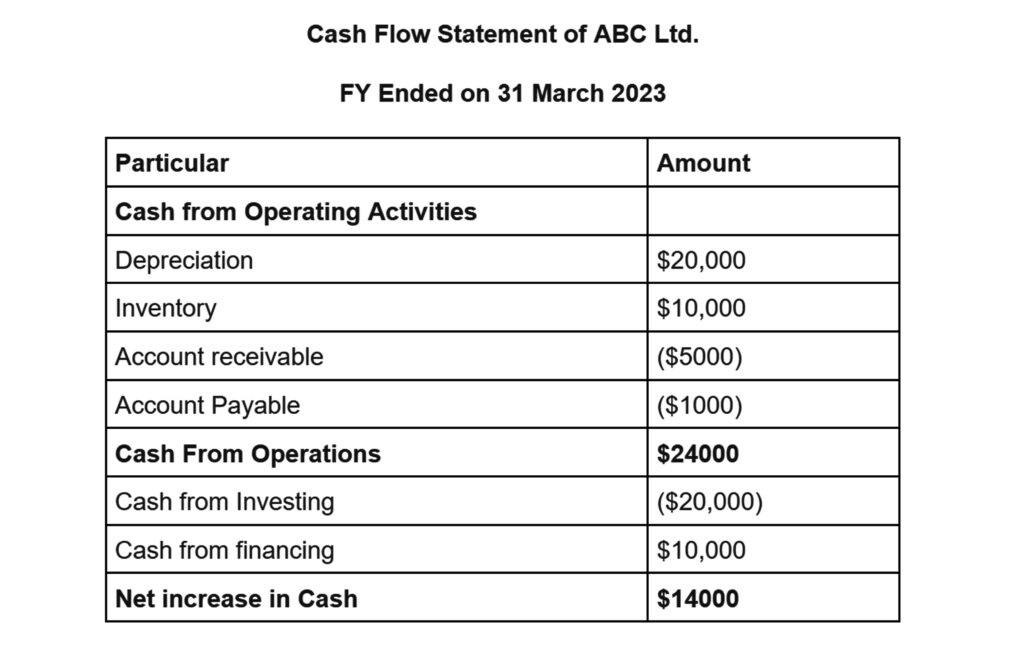

In the above cash flow statement analysis example, we found that the amount company generated is more than the amount it invested. Therefore it is a sign of the positive financial health of a company.

Conclusion

By learning the figures in a particular picture, we say that cash is king. Many analysts sense that the cash in the bank is an essential asset because it’s a thing that can’t impact through creative accounting.

The final word about cash flow statement analysis is if a company continually develops more money than it utilizes. The analysis of cash flow statement will possibly be able to do several helpful things with a surplus, such as

- To benefit shareholders and increase their dividend payments.

- Pay off current debts, lowering its price and cost on various payments of interest

- Multiple benefits of repurchasing shares.