Sentiment Analysis Tools, Types & Importance

One of the key pillars or foundations to start your trading journey is market analysis. Many traders prefer fundamental analysis, while many prefer technical analysis. But there is one more analysis that can take your trading to the next level, and that is sentimental analysis. In this article, we will study how to conduct this analysis with popular sentiment analysis tools and their importance.

What is Sentiment Analysis?

Market sentiment refers to the perception, opinion, attitude, or thoughts of a large group of traders or investors about a particular financial asset.

Sentimental analysis is analyzing and interpreting the market’s opinions, perceptions, or moods to make the right trade decision.

The price of financial assets is affected by many factors, and market sentiment is one of these factors.

Whether it is currency trading, stock trading, or any other market, the attitude of a trader can change the entire market condition, and that is the reason why sentiment analysis is becoming too popular these days.

You may have seen traders mostly trade in US Dollars; have you ever wondered why? The reason is traders believe in USD, which makes it a globally popular currency.

Similarly, the stocks of major companies like Alphabet, Microsoft, Amazon, etc., are quite popular amongst people, and their popularity contribute positively to the demand of stocks.

Here's a quick look at what you'll read

Sentiment in trading helps gauge market emotions—bullish or bearish—by analyzing news, social media, and positioning data. Traders use it to confirm trends, spot reversals, and avoid crowded trades.

Yes, sentiment analysis works in forex by assessing trader positioning (e.g., COT reports, retail sentiment) to identify potential reversals or trend strength, complementing technical and fundamental analysis.

The three types of forex analysis are:

- Technical Analysis – Uses charts and indicators to predict price movements.

- Fundamental Analysis – Evaluates economic data, interest rates, and news.

- Sentiment Analysis – Measures market mood through positioning and reports.

Use sentiment in forex by analyzing reports like the COT (Commitments of Traders) and retail positioning data. Extreme sentiment levels often signal reversals, while aligning sentiment with trend strength can confirm trade setups.

Sentiment Analysis Example

Suppose ABC is a popular Global e-commerce company. The founder of the company has posted a tweet favoring racism. As a result, all over social media, people started bashing the founder and boycotting the company.

In this case, this tweet will negatively impact the company’s stock and may raise negative sentiment in the market. So traders may go short.

Now, let us take a forex market example. Suppose you are trading in a USD/EUR pair. All over social media and news platforms, there is a perception that the USD will see a major rise against EUR.

The Forex experts and market makers also feel the EURO will fall against USD. So basically, the mood of the market is positive regarding the USD/EUR pair, triggering the bullish sentiment in the market.

Types of Market Sentiments

Before moving ahead with sentiment analysis tools, let us first discuss the types of sentiment and what they indicate for making trade decisions effectively.

Positive Sentiment

When the perception or opinion of most traders in the market is optimistic, prices are expected to rise, triggering bullish sentiment in the market. The positive sentiments may be triggered by favorable economic data, central bank announcements, speeches, and social media sentiments.

Negative Sentiment

When the market is pessimistic about financial assets, prices are expected to fall, triggering bearish sentiments. Generally, negative sentiments are triggered due to negative economic data, speeches, announcements, and news.

Neutral Sentiment

Neutral sentiment indicates indecision in the market. Generally, when there is no such impactful news, announcements, or speeches, the price starts moving sideways. Neutral sentiments lack traders’ confidence in bullish, or bearish directions. During such scenarios, traders should avoid taking any positions.

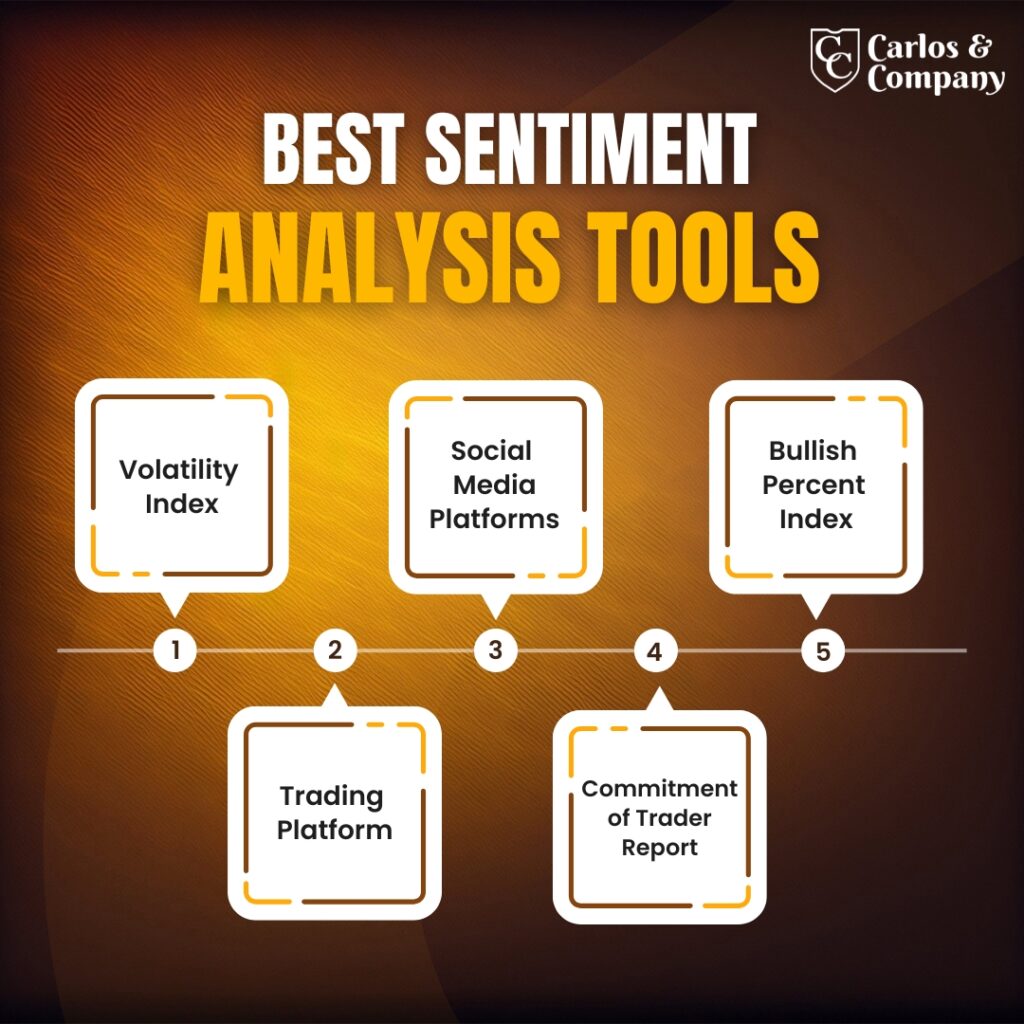

Best Sentiment Analysis Tools

Well, I hope you understand the concept of sentiment analysis. However, the important question is how will a trader identify the perception or sentiments of the market? For this purpose, you can use several sentiment analysis tools to analyze and interpret the sentiments. Let us have a look at these effective tools:

The Volatility Index

The Volatility Index, also known as the fear gauge, is among the most popular sentiment analysis tools, reflecting investors’ expectations from the US stock market.

VIX is the measure of the price fluctuation of the S&P 500 for the next 30 days. It can be useful for analyzing the stock market’s sentiment, or you can also interpret the mood of other financial markets.

A high VIX indicates larger price swings in the future that will result in uncertain market conditions and fear among investors. In such cases, Traders’ lack of confidence in the market reflects bearish sentiments.

A lower VIX indicates stable market conditions and small price swings, resulting in investor confidence in the market and suggesting potential bullish sentiment.

US Volatility Index Chart as on Dec 12, 2023

Social Media Platforms

The best aspect of trading in this digital world is social media platforms that help traders understand and interpret market mood. As we have studied above, one tweet from an influential person can change the entire market.

That’s how social media makes the game of trading more interesting. You can use Telegram, Facebook, Twitter, WhatsApp, etc for sentiment analysis. Also, you can get the opinion of expert and professional traders who have been working in the market for years.

Bullish Percent Index

BPI is amongst the popular sentiment analysis tools used to listen to what the market says. It is measured to indicate the index or assets generating bullish signals.

When the BPI percentage is around 70% or more, it indicates that the market sentiments are over positive or overbought condition; meanwhile, when the percentage is below 30%, it indicates extremely negative sentiment or over-sold conditions. When the BPI is around 50%, it indicates indecision or neutral sentiments in the market.

Commitment of Trader Report

It is a popular sentiment analysis report published by the Commodity Future Trading Commission, especially for commodity trading. COT reports major traders’ sentiments over a particular period; the report is prepared after considering the activities of commercial, non-commercial, and major traders.

You may have heard that the activities of major participants significantly affect the market, and it is quite true. So you can monitor COT reports to get the take of market makers on the current trend.

Trading Platform

You may have used platforms like Trading View and Meta Trader to get real-time data or monitor charts. However, you can also use these platforms for sentiment analysis. There are several trading platforms that provide traders with market insight, expert opinions, news analysis, traders groups, and many other facilities.

You can use these features to study the market’s sentiments and make trade decisions effectively. For this purpose, you can use platforms like StockTwits, Trading View, Reuters, Bloomberg, etc.

Importance of Sentimental Analysis in Trading

Traders generally give importance to technical or fundamental analysis. However, experienced traders and professionals believe sentiments can change the market scenario. So, let us discuss why sentiments play a crucial role in trading.

To get valuable market insights

Trading is the game of speculation or prediction where traders watch market conditions to make trade decisions. So, traders’ speculation can be right or wrong. Therefore, you can use sentiment analysis to find what most traders feel or get valuable insights.

Algorithm Trading

Sentiment analysis plays a major role in every trading strategy, including day trading, scalping, copy trading, or swing trading. However, in algorithms or automated trading, it is a must to organize this analysis.

Automated trading is the process of trading using automated software based on predefined strategies. These software or programs consider sentiment data for making quick trade decisions.

Confirmation

Many traders take place trade based on fundamental analysis factors like economic calendars, reports, and news; meanwhile, many traders place trade using technical analysis indicators like Bollinger bands, moving averages, and support or resistance for placing a trade.

However, whichever analysis you use, you should consider sentiment analysis for confirmation. You may have seen many traders lose money in the market even after organizing proper analysis. It generally occurs when you rely solely on one analysis, so you should use all three analyses to make the right decision.

Helpful in risk diversification

Sentimental analysis is applicable in different markets, including stocks, forex, indices, cryptocurrencies, and other financial assets. You can diversify your investment into different markets. Also, you can benefit from the correlations amongst various assets using this analysis.

Wrapping Up

We have studied all the important aspects of sentiment analysis. This analysis helps you stand out and make trade decisions effectively. However, a trader should understand that you cannot solely rely on this analysis as there is no foolproof plan to trade in the financial market.

So give priority to confirmation. In addition, the results also depend on how effectively you have conducted the analysis. A trader should first get well versed with the concept of this analysis, its strengths and weaknesses. Also, there are multiple paid and free sentiment analysis tools available. So combine your knowledge with technology for profitable results.