Volatility Index ETF: Trade Volatility Like a Pro

Volatility is the most crucial element on which the entire trading world relies. You can make money in the financial market only because of volatility.

No volatility means no price swings and no profit. Thus traders prefer trading volatile assets in the market. Do you know that you can even trade volatility with volatile assets?

Want to know How? The answer is the Volatility index ETF, one of the popular ways to make money from market volatility. In this blog, we will discuss Volatility ETFs and how to trade them.

What is the Volatility Index?

A Volatility Index, popularly known as VIX, is a benchmark for market volatility for the next 30 days. The index measures the expectation of volatility for the future days. It usually takes the S&P 500 index into consideration to provide market volatility insights.

The VIX index is also known as the fear index. High volatility means uncertainty and unpredictability, which results in high fear. Meanwhile, low volatility means stable and trade-favorable market conditions that result in a calm market.

Traders keep an eye on the volatility index in order to make sound trade decisions. The index is important for gold, forex, commodities, stocks, and indices traders. It provides traders with an overview of the market for the upcoming days.

Traders can plan their trade entries and exit by watching the index. Also, traders can even trade VIX index directly. There are many ways to do it, including VIX options, VIX Futures, and VIX ETFs.

Here's a quick look at what you'll read

The best VIX ETF to buy is typically ProShares VIX Short-Term Futures ETF (VXX) for short-term exposure.

The CBOE Volatility Index (VIX) is the most widely used and best-known volatility index.

Yes, ETFs like VXX, UVXY, and SVXY track volatility through VIX futures.

VIX measures expected 30-day volatility, while VXX tracks VIX futures contracts and not the index directly.

What are Volatility Index ETFs?

A volatility Index ETF is an exchange-traded fund that tracks the market volatility for the future days. Traders can predict the rise and fall of the volatility and make money from the price fluctuations.

Simply, when traders think that the market is going to become uncertain and expect volatility to increase they buy the ETFs. Meanwhile, when traders believe that volatility is all set to decline, they sell the volatility index ETFs.

Best Volatility Index List

Proshares vix short-term futures ETF (VIXY)

Best to take advantage of short volatility ETFs price fluctuations. Traders can get 1.5 to 2x leverage exposure.

iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX)

It’s a long volatility future index that tracks the performance of the S&P 500 index.

Simplify Volatility Premium ETF (SVOL)

SVOL ETFs allow you to make a profit from stable market conditions. Traders earn a premium when volatility declines, and the index loses value when volatility rises.

How to Trade Volatility Index ETFs

Understand Market Volatility

The concept of volatility is quite complex. Without volatility, trading will not place; more volatility increases the risk and uncertainty in the market, and low volatility results in a calm and stable market.

When trading volatility index ETFs, in-depth knowledge of volatility and the ETF market is essential. It will help traders identify buying and selling opportunities.

Select an ideal VIX ETF

Multiple VIX index ETFs are available in the market. Now, you need to select an ideal VIX ETF that fits your needs. You can consider factors such as knowledge, the time frame of volatility, capital, risk, and leverage to choose the best.

Watch the factor that moves Volatility

To predict the rise and fall of the VIX index, a trader needs to look at different factors that affect volatility. VIX ETFs tend to increase during economic crises, pandemics, geopolitical stress, war, and other unfavorable conditions. They tend to decrease during stable political and economic conditions, as well as bullish stock and commodity markets. So traders watch the entire market and make trade decisions accordingly.

Open long or short position

To identify buying and selling opportunities, you can use technical, fundamental, or sentimental analysis. Watch the VIX index charts, and use tools such as trend lines, indicators, and candlestick patterns to organize technical analysis.

Also, VIX ETFs tend to have a strong correlation with the stock, commodity, and forex markets. So, keep an eye on the overall fundamental analysis factors to identify opportunities.

Let us take the example of S&P500. VIX ETFs and S&P observe strong negative correlations. A rise in the S&P 500 indicates a drop in the VIX, suggesting traders open a sell position.

Meanwhile, a fall in the S&P 500 indicates an increase in VIX, which suggests a trader should open a buy position. That’s how traders can watch the S&P 500 and make trade decisions.

Monitor the Market and Adjust the positions

Once you have opened a trade, continuously monitor market conditions. A sudden event, announcement, or news release may affect the market significantly. So watch the market conditions and make changes accordingly. It will help you increase the chances of profit and limit the losses.

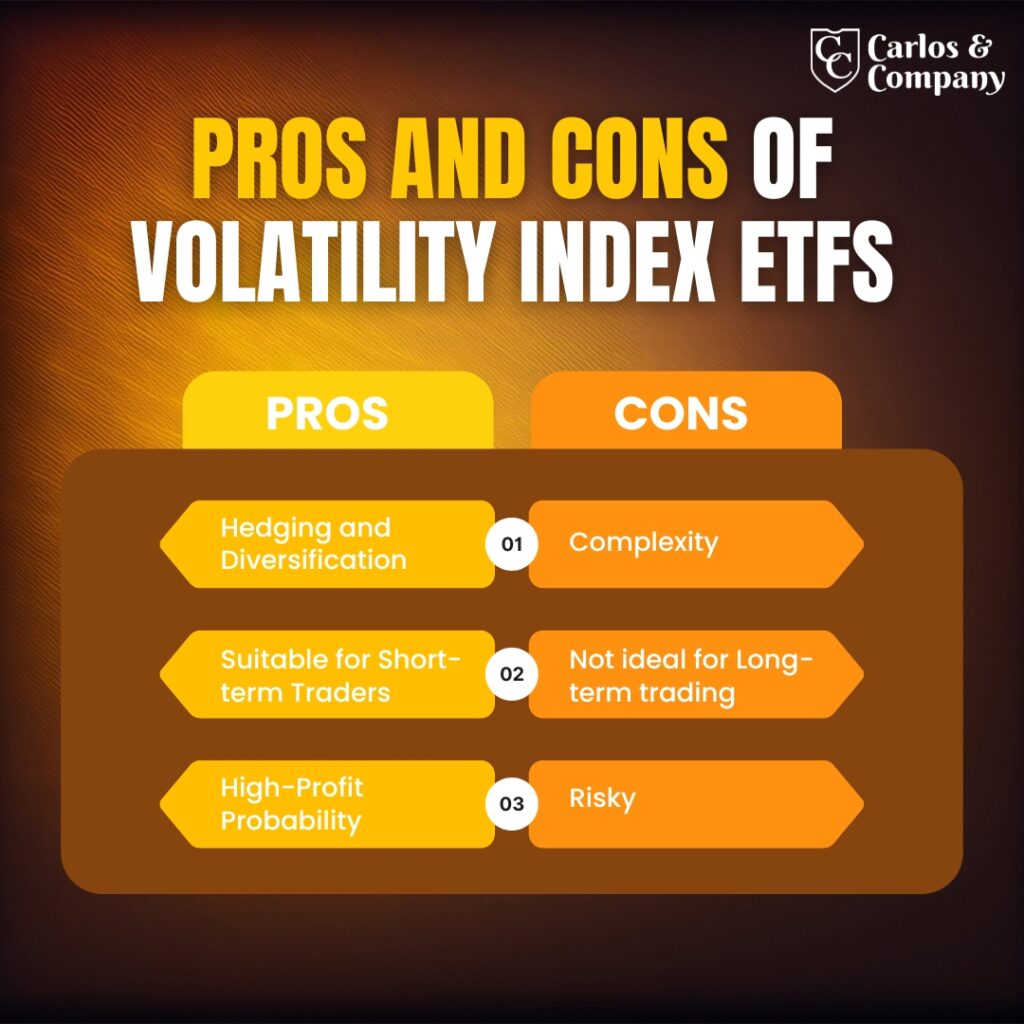

Pros of Volatility Index ETFs

Hedging and Diversification

Volatility ETFs can be ideal for hedging strategies. It has a correlation with different assets, so in case you think you are losing a position, you can offset the risk by trading these ETFs.

Also, the trading world involves significant risk, and spreading capital can help you manage the risk. Volatility ETFs can be an ideal option to diversify your investment portfolio.

Suitable for Short-term Traders

The volatility index saw significant price swings even during the short period. So the index is ideal for short-term strategies such as day trading, scalping, or swing trading.

High-Profit Probability

Volatility ETF indices are highly volatile and see potential price movements. It means if you follow the right approach and made an accurate prediction, the chances of making a high profit are high.

Cons of Volatility Index ETFs

Complexity

The concept of volatility is hard to understand, especially for beginners. It involves understanding diverse financial markets, assets, and global geopolitical and economic conditions.

Not ideal for Long-term trading

VIX ETFs may not be suitable for long-term strategies. It includes position trading, investment, or buy-and-hold strategy.

Risky

With high-profit potential, the chances of huge losses are also present with volatility index ETFs. So the risk is higher if you lack proper strategy, analysis, and risk management skills.

Wrapping Up

Volatility ETF Index is a valuable instrument in the financial market. Traders from all around the world can trade the index and make money from its price fluctuation.

Advanced traders with robust risk management, proper strategy, and the right psychology can make impressive returns. Even beginners can trade VIX but with little assistance.

At Carlos and Company, our research team provides daily VIX Analysis with potential buy and sell calls. Reach out to get assistance and make informed trading decisions.