False Breakout Strategy: Must to Know for Technical Analysis Trader

The most depressing in trading is when the market does not move according to your analysis. This happens for several reasons. False breakout is one of the key reasons.

Well, if you are also a technical analysis trader tired of false breakouts, then this article is for you. Here, we will discuss the false breakout strategy. So let’s get started.

Here's a quick look at what you'll read

A false breakout occurs when the price moves beyond a support or resistance level but quickly reverses back within the range.

Watch for low volume, quick price reversals, and lack of follow-through after the breakout.

Volume indicators, RSI, and candlestick patterns like pin bars can help spot fake breakouts.

Non-farm payroll is an employment fundamental indicator. It represents the total number of paid workers in the USA, excluding nonprofit organizations, private households, and farms.

What is a false breakout?

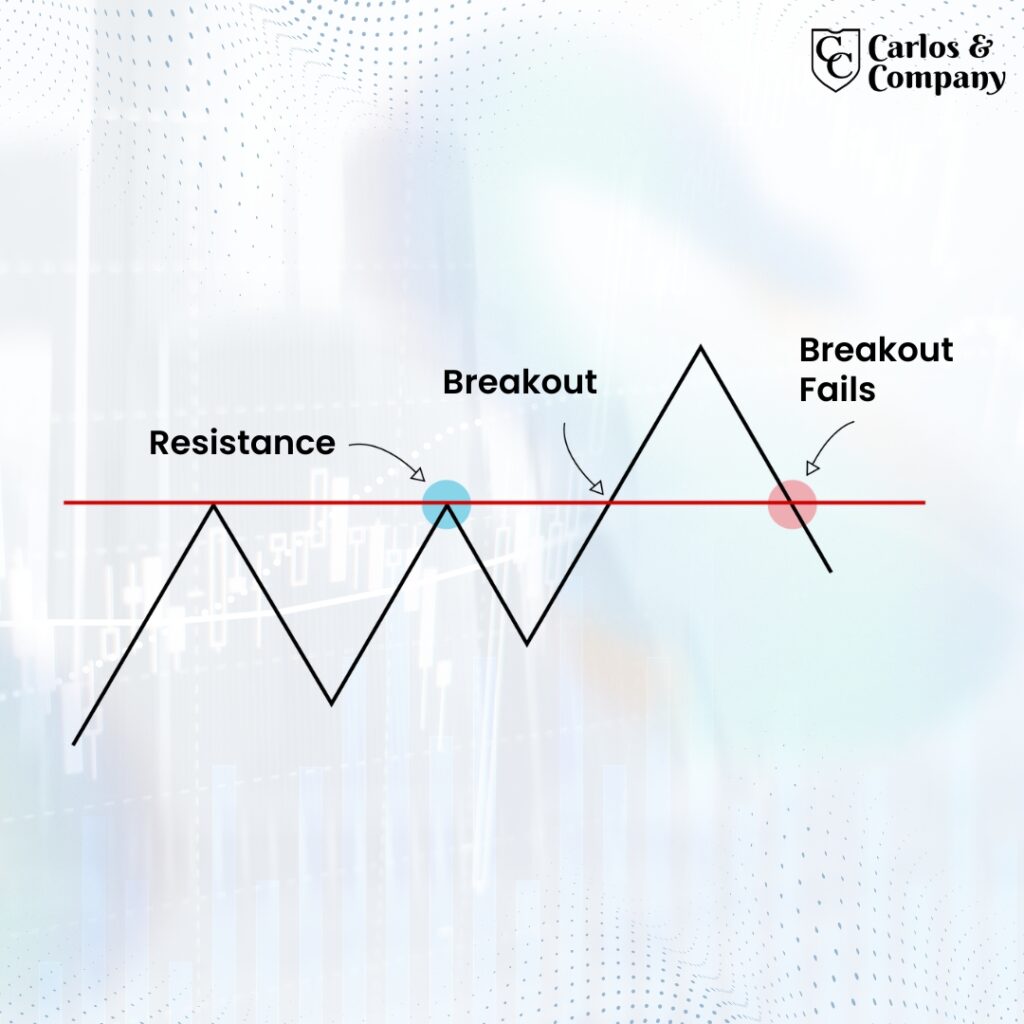

A breakout is when the price of an asset moves above or below the trading range. Simply, it is when the asset price breaks the key support or resistance levels.

A false or failed breakout is when the price touches or breaks the key levels but fails to be sustained for a significant period. It occurs when the price breaks the support or resistance, followed by a reversal.

Types of false breakouts

- A bullish false breakout occurs when the price breaks the resistance but, due to bearish pressure, again falls below.

- A bearish false breakout occurs when the price breaks the support level but, due to bullish pressure, again rises.

False breakout strategy example

Confused? Not to worry, let us see a false breakout example:

In the above image, You can see how, at the initial stage, the price reaches the resistance level and reverses back. The breakout occurs when the price ultimately breaks the resistance level.

Generally, when a price breakout occurs in an upward direction, it suggests a trader to open a long position. As a bullish breakout implies, bulls have managed to push the price above the key level, and now the price is expected to rise again.

But in the above example, if you end up opening a long trade, then you may suffer a loss. Do you know why?

The answer is because of a false breakout. Many traders suffer a loss because they don’t wait for breakout confirmation.

In the above example, a breakout has occurred but failed to be sustained for a long period. As a result, if you open a long position, you will suffer a loss.

That’s why understanding a false breakout trading strategy is a must. It will help you identify real vs fake breakouts and make trade decisions accordingly.

What Causes False Breakout

Market Manipulation

The trading world is dominated by big market players, popularly known as whales. These participants include big multinational corporations, central banks, governments, and broker platforms.

These players place high-volume trades that significantly affect the asset price. Market manipulations are when they intentionally push asset prices to fool traders. In such cases, a false breakout may occur, and traders may end up opening a wrong trade.

Less Liquidity

Liquidity refers to the ease of opening or closing trade at a favorable price. When the trading volume is high, liquidity is more, and when the trading volume is less, liquidity is less.

Less liquidity causes unstable market conditions and high price swings. Predicting the rise and fall of the asset becomes difficult when there is less liquidity. It ultimately leads to a failed breakout.

Sudden Market Upturn

The financial market is dynamic and changes due to changes in geopolitical, economic, and global conditions. Events such as economic reports, announcements, speeches, disasters, and many others have a significant impact on prices. They can even push the price back during breakouts.

Sideways Market Conditions

The price of the asset moves within a narrow range during a sideways market. This happens when both bulls and bears try hard to push prices. In such cases, even if one party manages to push the prices, another party again pulls it back to the range. As a result, a false breakout occurs.

How to identify False Breakout in Trading

Identifying real breakout vs fake breakout is essential to make the right decisions. Many traders struggle at this stage. However, it is not that difficult. Here are some tips that can help you in doing so:

Grab Market Knowledge

The ability to identify false breakouts comes with market knowledge. You should clearly understand what asset you are trading and the factors that affect its price. So, even if technical analysis tools give false signals, you can identify them.

Practice Price Action

Price action traders study historical price patterns to make buying and selling decisions. It involves the knowledge of technical analysis, candlestick patterns, trendlines, momentum, and indicators. With the understanding of price actions, spotting false breakouts becomes relatively easy.

Wait for Trade Entry

The biggest mistake traders make is opening a trade when the price breaks the support or resistance level. However, that’s the difference between an amateur and a professional trader. At this stage, wait for breakout confirmations to measure the strength of the breakout.

Keep an Eye on Overall Market Condition

A false breakout often occurs during a change in the current market conditions. Watch fundamental events such as news, announcements, and economic data releases to spot fake breakouts.

Use a Combination of Trading Indicators

Do not rely on a single charting pattern or indicator to identify breakouts. As technical analysis, tools may generate false signals. So, use a combination of indicators. It will help you confirm the indicator interpretations and make sound trading decisions.

Use Multiple Time Frames

The strength of the breakout also depends on support and resistance levels. Sometimes, traders identify vague trade key levels and end up trading fake breakouts. Thus, to avoid such a scenario, watch multiple time frames. It will provide you with a clear picture of asset price movement.

Final Words

False breakout strategy is applicable in forex, crypto, stock, indices, and other financial market. Both breakout and false breakout are common scenarios in all markets.

Many traders make wrong decisions just because of fake breakouts. Thus, clearing the basics is important for the development of the best false breakout strategy.

If you are struggling with a trading breakout, then worry not. Carlos and Company is there for you. We can assist you in making informed trading decisions even during false breakouts. Reach out to join today.