Crypto Lead-In to Coin: How Digital Tokens Turned Into Real Value

Cryptocurrency is playing a bigger role in the financial world now. It has come a long way. What began as a digital code is now used like real money. Coins like Bitcoin, Ethereum, and Dogecoin hold real value and are accepted in many places.

The phase ‘crypto leads into coin’ reflects how digital tokens turned into trusted, tradeable assets. Today ,people use crypto to shop, invest and send money easily.

As trust grows and more businesses accept crypto, its value continues to rise. Beginners can also take part using simple apps and tools.

At Carlos and Company, you can find clear and simple information that help people learn how crypto works in the real world, without making things too technical.

Whether you are new to this or already using crypto, understanding how it gained real value is the key to using it smartly.

What Does “Crypto Lead-In to Coin” Mean?

The Crypto lead-in to coin might sound confusing at first, but breaking it down makes it clear, especially for those exploring the world of cryptocurrencies or solving crossword clues.

- Crypto is often used as a shorthand term for cryptocurrency, which encompasses digital currencies such as Bitcoin, Ethereum, or Dogecoin.

- A “lead-in” is a prefix or other introductory part that comes before another word.

- Here, “coin” refers to a cryptocurrency token that can be used for transactions, trading or investing.

Here's a quick look at what you'll read

The value of cryptocurrencies goes up or down due to supply and demand, how people feel about the market, news, new rules, how investors act and changes in inflation or interest rates.

To know which crypto might go up today, monitor real time charts, trading volume, social media trends, news updates, technical indicators on various platforms.

Cryptocurrency is valued based on how much is supplied and how much is demanded. There is no central body in charge; instead, the price of cryptocurrencies is affected by how people feel about them, their usefulness and how many people use them.

Cryptocurrency can decrease in value when demand is low, there is bad news, regulations are tightened, the market crashes, or there are security issues. When investors panic and start selling, prices can drop very quickly.

When demand goes up, supply stays low, and there are positive signs like more people using cryptocurrency, media interest and investor confidence, the value of cryptocurrency tends to rise.

Crypto is rising today because of more institutional investments, encouraging economic news, less tension between countries and increased hope for clearer rules for digital assets.

The Journey: How Cryptocurrency Gained Real Value

When Bitcoin was created in 2009, it had no real market price. It was just a digital idea shared among tech enthusiasts. But in the years that followed, Bitcoin grew from being worth less than a cent to trading at over $65,000.This massive jump made people take notice.

So, how did crypto gain value?

One major reason is limited supply. Bitcoin has a cap of 21 million coins, making it scarce, just like gold.

As the number of interested people increased, the demand went up, but the supply did not change. As a result, prices increased.

Public trust is also a major consideration. As more people learned about crypto, trust in it increased. An increasing number of people began to purchase, keep and use it for transactions.

Support from institutions was also very important. Tesla is one of the big companies that bought Bitcoin and also lets people pay for cars with it. Users can now buy and sell cryptocurrencies through PayPal. This made crypto seem more practical and relevant for daily use.

When digital code becomes real money, we call it a “crypto lead in to coin.” It is the stage where a digital asset earns trust and is used by people, much like money.

With the rise of more platforms, apps and businesses, crypto is now accessible to more people than just investors. It is now a common way for people to manage, use and consider their finances.

Present-Day Prices: How Valuable Are These Coins Now?

Cryptocurrencies have real value and are used in many countries. Prices for many cryptocurrencies were initially close to zero, but now some are valued at thousands of dollars. It demonstrates how much crypto has led the way in the coin journey.

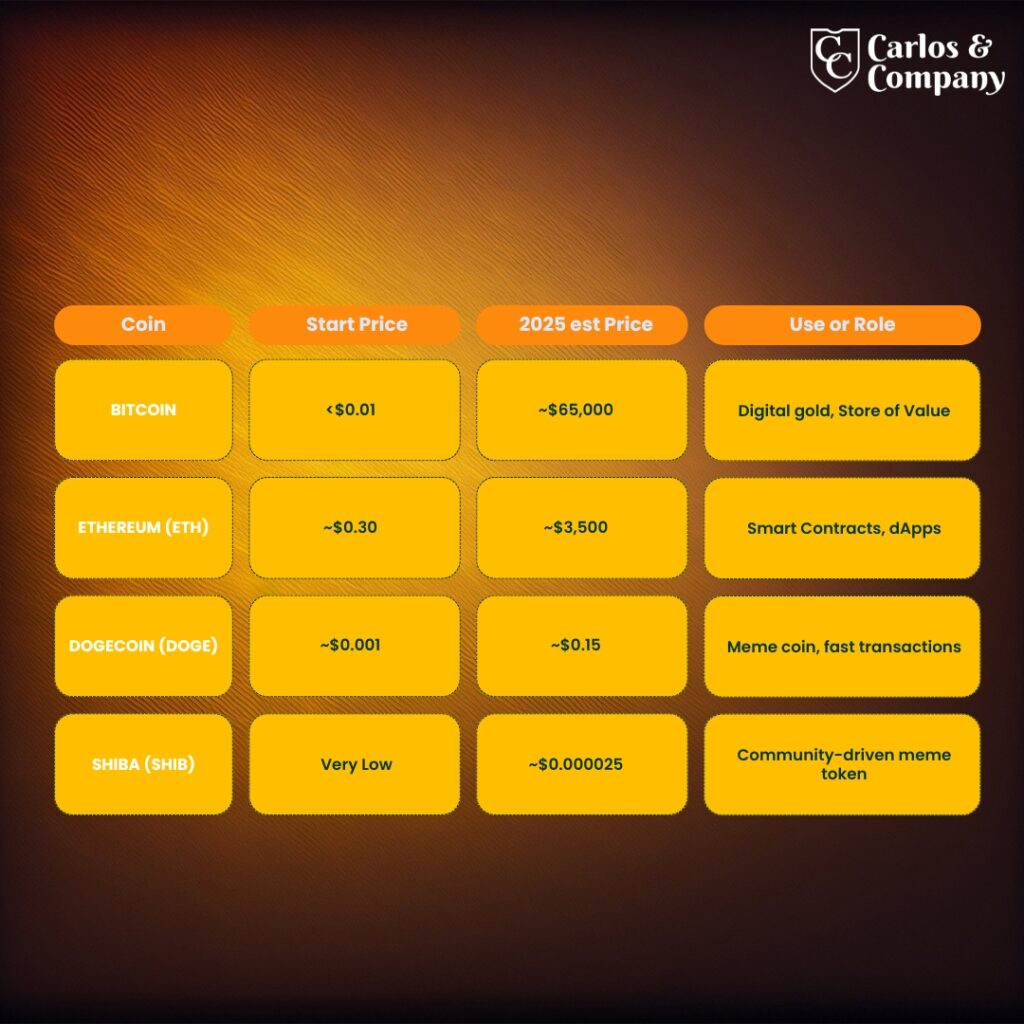

Here’s a simple look at how some popular coins started and where they are now:

These coins are no longer just digital codes. They can be used for payments, trading and investment just like regular money.

This rise in price and real-world use shows how crypto gained value and became a serious part of today’s financial world.

Real-World Use: How Crypto Works Like Money

Nowadays, cryptocurrency is used for more than just trading or keeping it. In many places, cryptocurrency is treated as real money. This is a major step in the crypto-led coin journey, as it takes digital code and makes it useful in real life.

Many companies now allow customers to pay with crypto. You can spend your Bitcoin or Ethereum to buy things online, purchase gift cards or pay for services such as travel and food. In some places, you can use Bitcoin ATMs to get cash, and in others, you can pay your bills with cryptocurrency.

With Coinbase, Binance and PayPal, users can transfer crypto just as easily as they would money. It demonstrates that cryptocurrency became more valuable as it became an integral part of people’s routines.

As more companies and services start using crypto, it becomes more important in the economy. More people rely on it, which leads to greater demand.

This shows that crypto is not just a fad. It is becoming a new method for storing and spending money—secure, fast and available worldwide.

Understanding Popular Coins Like DOGE, SHIBA, ETH

It can be helpful to examine some of the most famous coins to understand how crypto gained value. They began as digital concepts, but now millions use them and they have real value.

Dogecoin (DOGE)

Dogecoin started out as a joke, but it soon became well-known among cryptocurrencies. It is quick, simple to operate and has a large online following. Being featured in memes and pop culture made more people want to own it, which increased its value. Even though it is affordable, many people are interested in trading it.

Shiba Inu (SHIBA)

SHIBA is a meme-based coin that became popular because of support from the community and online chatter. Since it’s so affordable per unit, many people purchase a lot of it. Even though SHIBA was created as a joke, its increasing role in NFTs and payments adds value to it.

Ethereum (ETH)

Ethereum is not limited to being a coin. Developers can use it to create apps and smart contracts. The fact that Ethereum is used in real life makes it valuable. ETH is the second most valuable crypto, and many investors trust it.

They demonstrate how these tokens started as fun or technical projects and ended up being valuable assets. All of them became more valuable because of community backing, actual uses and increasing trust in cryptocurrencies.

By knowing about these coins, you can see why the crypto world is growing and why digital coins are becoming more important to many people.

Conclusion

The price of cryptocurrency is affected by demand, changes in the market, news and how interested investors are. Since changes may occur rapidly, keeping yourself informed is very important. With more people getting involved in digital assets, it is even more important to have clear and helpful information. That’s why platforms like Carlos and Company are so useful. They give dependable advice that helps people grasp how cryptocurrencies function. No matter your experience, using reliable sources helps you feel more confident and make better choices in the fast-changing crypto world.