Effective Exit Strategies

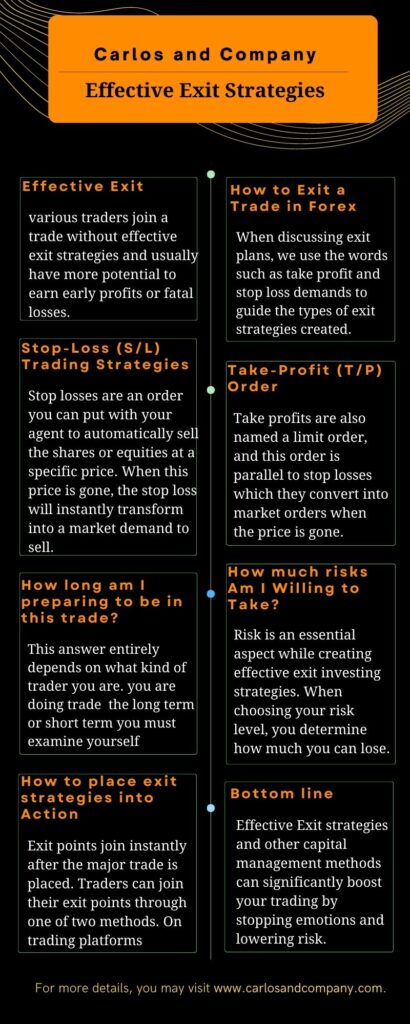

Capital management is one of the essential factors of trading. For example, various traders join a trade without effective exit strategies and usually have more potential to earn early profits or fatal losses. Traders must know how to identify exit and entry points that will help reduce losses and close profits.

Here's a quick look at what you'll read

There are only two methods you can get out of trade: Via Bearing a loss or earning a profit.

- Stop-Loss (S/L) Trading Strategies

- Take-Profit (T/P) orders strategies

- Good till canceled

- Day orders

- Following stop

Three things should be evaluated when creating strategies.

- How long am I preparing to be in this trade?

- How many risks Am I Willing to Take?

- How to place exit strategies into Action?

How to Exit a Trade in Forex

When discussing exit plans, we use the words such as take profit and stop loss demands to guide the types of exit strategies created. Through traders, sometimes, these words are shortened to T/P and S/L. You can only get out of trade two methods: Via Bearing a loss or earning a profit.

Stop-Loss (S/L) Trading Strategies

Stop loss is a forex market order you can put with your agent to automatically sell the shares or equities at a specific price. When this price is gone, the stop loss will instantly transform into a market demand to sell.

It is one of the most popular Forex entry and exit strategies that can help reduce the market’s losses. Various rules are involved in all stop-loss orders.

- Stop-losses are set above the existing asking price on the purchase and below the current price of the bid on sale.

- Once the stock is mentioned at the stop-loss price, the new york stock exchange stops losses evolving into market demand.

- NYSE and AMEX stop losses give you the right to the next market sale when the price exchanges at the stop cost.

There are three kinds of stop-loss orders.

- Good till canceled:- This kind of order suggests until an implementation happens or until you manually cancel the order.

- Day orders:-This order expires after one day of trading.

- Following stop:- This order tracks at a fixed distance from the market cost but never drives downward.

Take-Profit (T/P) Orders

Take profits are also named a limit order, and this order is parallel to stop losses which they convert into market orders when the price is gone.

Apart from this, take profit price stick to the exact rule as stop-loss has in terms of implementation performs on the NASDAQ, NYSE, AND AMEX trading.

Yet, there are two differences.

- There is no trailing price.

- The exit point should be placed above the current market cost rather than below.

Creating Effective Exit Strategies

Three things should be evaluated when creating intraday entry and exit strategies for financial trading.

How long am I preparing to be in this trade?

This answer entirely depends on what kind of trader you are. If you are doing trade for the long term(More than one month), you must focus on the following point.

- Fixing profit targets to be hit in many years will determine your trades.

- You are developing the trailing points of stop-loss that enable profits to close each iso, usually to limit your downside possibility. The immediate goal of long-term investors is usually to keep capital.

- Bearing profit in increments over some time to lower volatility while liquidating.

- You are enabling volatility to save your trades to a minimum.

- You can create exit plans based on the long-term’s fundamental analysis aspects.

If you are in the trade for the short term, you must examine yourself with these things. Developing near-term profit targets that implement at appropriate times to increase profits. Here are some typical implementation points your exit strategy framework must include.

- Pivot

- Points

- Fibonacci

- Levels

- Trend

- Line breaks

- Other

- points

- Immediately eliminate the underperforming holding by developing solid stop-loss points.

- You can create forex exit strategies that impact the short-term based on technical or fundamental aspects.

How much risks Am I Willing to Take?

Risk is an essential aspect while creating effective exit investing strategies. When choosing your risk level, you determine how much you can lose. This will also decide the trade size and the kind of stop-loss you will utilize.

Those who need less risk manage to place more closed stops, and those who take more risk provide more significant downward space. Another essential thing to do is to put a stop-loss price to save them from the place by average market volatility.

This data can give you a great idea of how volatile the stock is close to the general market. If this indicator is performed between zero and two, you will probably be secured with a stop-loss price of 10 to 20% less than what you purchased.

Yet, suppose the stock has three-bet upwards. In that situation, you should assume by putting a lower stop loss or searching for a critical level to depend on another important point (Like a 52-week low).

You may request to put a take-profit or exit point where you sell when your share is performing nicely. Many individuals attached to their holding equities and held these equities when the trade fundamentals changed.

Conversely, people sometimes fear and sell their holding equities when there has been no change in trade fundamentals. You can suffer losses and miss the various profit opportunities in both cases. You must use a right trading psychology and fix a point to help you grab the profit opportunities.

How to place exit strategies into Action

Exit points join instantly after the major trade is placed. Traders can join their exit points through one of two methods. On trading platforms, most brokers have the capability to enter orders.

Otherwise, many brokers enable you to contact them to identify entry points. However, there is one oddity, several brokers do not keep trailing stops. For that reason, you might have to recalculate and modify your stop-loss for every specific month or week.

Those traders who don’t have the capability can use a different technique for entering the orders. Limit orders also perform at specific price levels. You can also sell the exact price of shares that you held by putting a limit order and efficiently placing a take-profit or stop loss.

Bottom line

Effective Exit strategies and other capital management methods can significantly boost your trading by stopping emotions and lowering risk.

Before you create a trade, Read the three queries mentioned above and place a point at which you will trade for gains and others at which you will sell for a loss.