How Does Forex Market Works

Before discussing how does forex market works, First, understand the forex market. Governments, Nations, organizations, and individuals require foreign currencies for various purposes.

Currencies are exchanged for global trade, commerce, GDP comparisons, maintenance of forex reserves, travel, portfolio diversification, currency risk management, etc.

Here's a quick look at what you'll read

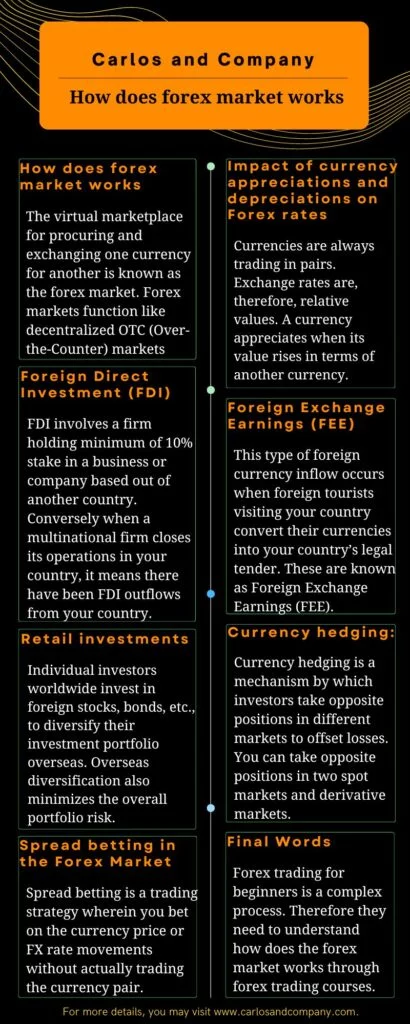

The virtual marketplace for procuring and exchanging one currency for another is known as the forex market.

A currency appreciates when its value rises in terms of another currency and vice versa. Exchange rates are relative values of currency pairs.

1. Foreign Direct Investment (FDI)

2. Foreign Exchange Earnings (FEE)

3. Retail investments

4. Currency hedging

Spread betting is a trading strategy wherein you bet on the currency price or FX rate movements without actually trading the currency pair.

What’s forex market?

The virtual marketplace for procuring and exchanging one currency for another is known as the forex market. Forex markets function like decentralized OTC (Over-the-Counter) markets with minimal governmental controls and no physical exchange floor.

As of 2022, the global forex market is valued at $753.2 billion. Forex trades worth $6.6 trillion are executed daily. The instruments with the highest daily turnovers are forwards, forex swaps, currency swaps, and options.

79% of international trade occurs in five major hubs – the UK, USA, Japan, Singapore, and Hong Kong. The major FX pairs traded are USD/GBP, USD/JPY, USD/EUR, USD/AUD, USD/CAD, USD/CNY, and USD/CHF. So it is the process where the forex market works in different countries.

Now the question is who controls the forex market where daily trillions of dollars are traded.There is no physical location or a central authority like the stock exchange or commodity market in the FX market. The respected government and institutions regulated trading activities in forex.

Impact of currency appreciations and depreciations on Forex rates

Currencies are always trading in pairs. Exchange rates are, therefore, relative values. A currency appreciates when its value rises in terms of another currency.

Conversely, a currency depreciates when its value falls with respect to another currency. One will be the stronger or appreciating currency in an FX pair, while the other will be the weaker or depreciating currency. Let’s have a look at the forex trading

example: Suppose the price of the USD/JPY pair is 110.69. It means that 1 USD equals 110.69 Yen. USD is the base currency, and JPY is the quoted currency.

In other words, the base currency is expressed in terms of the quote currency. If USD appreciates, the import costs of US goods will rise for other countries. Moreover, the value of their exports in terms of USD will fall.

Different types of forex market investments that work

If you are wondering how to forex trade for beginners, then look at the different ways you can invest your money in the FX market.

Foreign Direct Investment (FDI):

FDI involves a firm holding minimum of 10% stake in a business or company based out of another country. In other words, when a foreign firm sets up a new venture or becomes a controlling owner in a business based in your country, it means that FDI has flown into your country.

Conversely, when a multinational firm closes its operations in your country, it means there have been FDI outflows from your country. In FY 2020-21, FDI inflows into India totalled a record-high value of $81.72 billion.

Foreign Exchange Earnings (FEE):

The other type of foreign currency inflow occurs when foreign tourists visiting your country convert their currencies into your country’s legal tender. These are known as Foreign Exchange Earnings (FEE).

In 2018 and 2019, the FEE of India stood at $28.59 billion and $29.96 billion, respectively. However, between January to June 2020, the FEE dropped significantly to $6.15 billion due to the COVID-19 pandemic.

Retail investments:

Individual investors worldwide invest in foreign stocks, bonds, mutual funds, etc., to diversify their investment portfolio overseas. Overseas diversification also minimizes the overall portfolio risk.

For example, if you have $10,000 worth of investment in Apple and Tata power stocks. Then, for some reason, the US stock market crashed, and the Indian stock market is doing well; the gains from Tata Power stocks will mitigate your losses from holding Apple stocks.

The converse is true if the Indian economy is going through a rough patch while the US economy is doing well.

Currency hedging:

Currency hedging is a mechanism by which investors take opposite positions in different markets to offset losses. You can take opposite positions in two spot markets and derivative markets in fx hedging.

For example, you are bullish about GBP currency vis-a-vis USD. Currently, the GBP/USD exchange rate is 1.39. Thus, at the current conversion rate, 10,000 GBP equals USD 13,913.65.

Suppose, a month later, the GBP/USD FX rate falls to 1.35, and you convert the USD back to GBP. Now, you get 10,306.40 GBP. You made a gain of GBP 306.40.

How does the forex market work?

Spread betting in the Forex Market

Spread betting is one of the advanced Forex trading strategies wherein you bet on the currency price or FX rate movements without actually trading the currency pair. There are three aspects to it that works in the forex market – expected FX rate direction (bullish/bearish), bet size, and speculated spread.

The spread is the difference between the bid and ask price of an FX pair. The lower the spread, the more lucrative it is due to reduced transaction costs.

You can resort to leveraged trading strategy while engaging in spread betting. Under a leveraged trading mechanism, you must pay your broker a small margin amount.

The margin amount will be a certain percentage of the total transaction value. Such a trading strategy will allow you to take large positions in the forex market with less money in your pocket.

Spread betting can also be undertaken using other trading strategies like scalping, forex hedging, news trading, and trend trading. Forex scalping involves holding long and short positions in FX pairs for seconds or minutes.

It could be a profitable strategy when the exchange rates are very volatile. Trend trading strategy is quite commonly used for spread betting. It involves going long when the price is moving up and going short when it is moving down. As the name suggests, news trading involves taking a position based on the current forex market updates.

Final Words

Forex trading for beginners is a complex process. Therefore they need to understand how does the forex market works through forex trading courses or classes.

In FX Market, the strength of a currency is determined by demand and supply forces. The US dollar is the de facto currency for global trade and commerce. Most nations maintain the US dollar as a reserve currency.

Hence, the demand for the US dollar is usually high in the forex market. Moreover, the value of a currency in the forex market is usually determined by pegging it to the US dollar. Other powerful currencies are AUD, GBP, EUR, CAD, JPY, CHF, etc.

The forex market allows investors, businesses, and countries to convert currencies and manage currency risks by locking in an exchange rate. Most retail investors can also benefit from overseas risk diversification through forex market investment.