Forex Trading Terminologies for beginners

As a new forex trader, you must have heard many forex trading terminologies during the initial stage. These terms may be unusual and confusing for you. This article will teach you about these complex Forex terms with proper definitions and concepts.

Various terms associated with the forex market may affect your profitability and stability. Learning forex trading terms to become a pro in trading is essential.

Understanding these various forex concepts are effective because it will make thing easy for you while trading in forex. We will look at some essential forex terms and concepts to nourish your knowledge and make you an expert in the forex market.

Our list of Forex Terminology for beginners involves currency pair, exchange rate, base currency, quote currency, long position, short position, bid price, ask price, spread, pips, lot, leverage, margin, stop loss, and Take profit. Let us discuss what all these mean one by one.

Here's a quick look at what you'll read

- Currency pair

- Exchange rate

- Base currency

- Quote currency

- Long position

- Short position

- Bid price

- Ask price

- Spread, pips

- Lot

- Leverage

- Margin

- Stop loss

- Take profit.

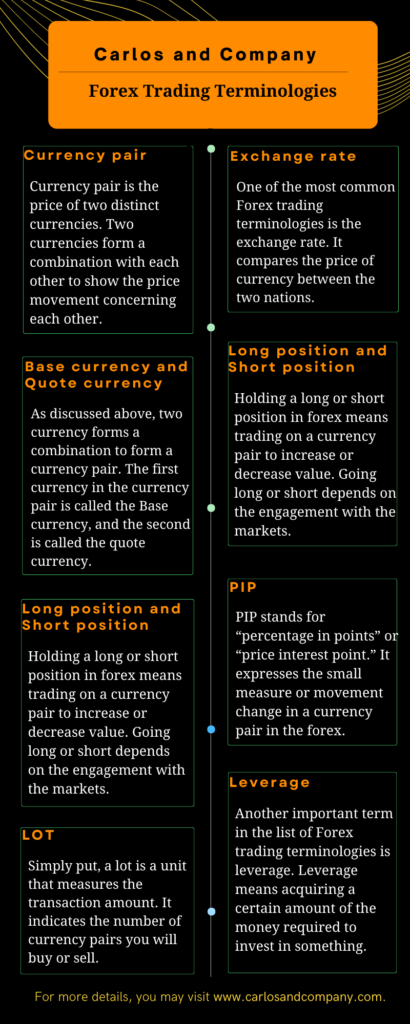

A currency pair is the price of two distinct currencies. Two currencies form a combination with each other to show the price movement concerning each other.

The exchange rate is the price of currency between the two nations. It means the value of one nation’s currency concerning another.

Leverage means borrowing a certain amount of the money required to invest in something.

Margin is the amount of money a trader requires to establish an open trade.

Some important Forex trading terminologies

Currency pair

A currency pair is the price of two distinct currencies. Two currencies form a combination with each other to show the price movement concerning each other.

The first currency of a currency pair is the base currency, and the second is the quote currency. Both the Base currency and quote currency compare the value to each other.

It shows how much of the quote currency is required to purchase one unit of the base currency. These currency pairs are traded in the forex market for buying, selling, exchanging, and speculating of currencies.

For example, in EUR/USD, the US dollar and Euro are combined to form a currency pair for trading. Hers EUR is the base, and USD is the quote currency.

Exchange rate

One of the most common Forex trading terminologies is the exchange rate. It compares the price of currency between the two nations. It means the value of one nation’s currency concerning another.

For example, if you want to buy the Euro in exchange for US dollars, the transaction will be done as per the current price of the two separate currencies.

Base currency and Quote currency

As discussed above, two currency forms a combination to form a currency pair. The first currency in the currency pair is called the Base currency, and the second is called the quote currency.

In currency trading terminologies, the base currency represents how much of the quote currency is required to get one unit of the base currency. For example, in the currency pair EURUSD, EUR is the base currency, and USD is the quote currency.

Long position and Short position

Holding a long or short position in forex means trading on a currency pair to increase or decrease value. Going long or short depends on the engagement with the markets.

When traders go long, they will have a positive investment balance in an account, hoping the price will increase. When a trader goes short, they will have a negative investment balance, hoping the price will decrease.

So traders hold the position according to the relative increase and decrease in the price. For example, if someone is trading in EURUSD, they will hold the position as per the relative increase and decrease in the quoted currency (USD) price.

Bid price and Ask price.

In financial trading, the bid price is the rate a dealer is willing to pay for a currency. On the other hand, the ask price is the rate at which a dealer will sell the same currency.

For example, David wants to exchange his US dollar in return for Euros; he found two dealers with different exchange rates of 1.30 and 1.40, respectively.

David found the first one cheap and exchanged US dollars with the first dealer. In this situation, 1.30 and 1.40 rates are the respective ask price of the dealer, and 1.30 is the buyer’s bid price.

Spread

Spread arises when the currencies are exchanged. The difference between the ask and bid prices is called the spread.

Hence, the difference in the selling rate of forex brokers and buyers’ buying prices is termed a spread. Thus, the difference between the seller’s and Davids’s buying rates is the spread in the above example.

PIP

PIP stands for “percentage in points” or “price interest point.” It expresses the small measure or movement change in a currency pair in the forex.

A pip is a fourth and final number after the decimal point (except for Japanese yen-based currency pairs. These are illustrated to only two decimal points).

For example, if any trader earned 40 pips, there is a 40 pips movement between the currency pair he traded.

LOT

Simply put, a lot is a unit that measures the transaction amount. It indicates the number of currency pairs you will buy or sell.

Any trader often orders the quantity during his trading session in the forex market. There are four types of lots named standard, mini, micro, and nano. For example

One standard lot = 100,000 units of currency

1 mini lot = 10,000 units of currency

one micro lot = 1000 units of currency

1 nano lot = 100 units of currency

Leverage

Another important term in the list of Forex trading terminologies is leverage. Leverage means acquiring a certain amount of the money required to invest in something.

Thus, in the case of the forex market, money is normally borrowed from a broker. Forex trading does allow high leverage because, for an initial margin requirement, a trader can develop higher because it will help in smooth investment.

You need to divide the total transaction value by the amount of margin you are required to put up to derive the margin-Based leverage:

Margin-Based Leverage = Total Value of Transaction / Margin Required

Margin

Margin is the amount of money a trader requires to establish an open trade. When you trade forex on margin, you only require to pay a percentage of the whole value of the position to open a trade.

It helps small traders to increase their position size. Margin is one of the important terms in the list of various Forex market terminologies. The formula to calculate the margin level is as follows:

Margin level = (equity / used margin) x 100

Take profit and stop loss.

Two common beneficial technical analysis tools available in forex trading terminologies are the “Take Profit” and “Stop-Loss.” These enable traders to define when to stop an order, maximise profits or reduce the risk of major losses.

Stop loss and take profit are marvelous tools to help with risk management strategies and, consequently, your financial returns.

A stop-loss order is placed with a broker to buy or sell a security when it reaches a specific price. Stop-loss orders are composed to limit an investor’s loss on a position in a security.

Stop loss is the place to avoid the lowest minimum loss on the trade, while Take profit is placed to gain the maximum profit on the trade.

For example, if you gain on a trade, the currency-pair price reaches take profit, and when you lose on a trade, it means the price of currency-pair reaches stop loss as per the buy and sell of currency and vice-versa.

Stop-loss acts as an order which helps traders to limit losses in an open position if the underlying assets reverse their moving direction opposite of the expectation of the trader.

In this case, the trade can cause losses; we can put stop-loss order to limit those losses. Stop loss is very important to place because you can avoid a big loss on your trade.

Conclusion

If you are new in the field of forex trading, then you need to learn and understand these terms before starting actual trading on a real account. You can also trading courses available various website to have a detailed understanding of these terms. Forex trading is worth it or not, depending on these factors.

If you do not engage yourself in conceding these essential forex trading terminologies, then you may ruin your account soon. It will result in short stability in the forex market.

Thus it is very important to understand forex trading terms as it will help you to invest in the right opportunity. If you focus on and learn these forex trading terms, you will easily place the right trade.

By learning these terms, you will able to find the right opportunities which will help you in making your trade entry and exit strategies. Forex trading concepts are vast, and it needs time to understand them completely because they also contain many difficult terms.

You should give time to learning and understanding these because it is a crucial step before starting forex trading.

Understanding the concept of Forex trading terms will take time for beginners. But once you learn about this term, you will become a pro while trading in forex.