All you need to know about swap in forex trading with examples

Swap in Forex determines the Rollover Cost and interest rate differential. However, many traders don’t know the meaning of swaps and its importance. Let us practically understand the concept of swap.

What is a swap in Forex?

Swap is a term that refers to the interest a trader pays or earns when you are trading overnight.

Simply put, a swap refers to the difference between the interest rate of two currencies when you hold a position overnight or beyond the end of the financial trading day.

A swap is a contract where one currency is borrowed, and another is lent simultaneously, and then the amounts are exchanged on maturity.

Here's a quick look at what you'll read

A swap in forex trading is the interest paid or received for holding a currency position overnight.

Swaps work by reflecting the interest rate differential between the two currencies in a pair, where traders either pay or earn interest depending on the trade direction.

Swap cost is the fee or credit added to your account for holding a currency position overnight, based on the interest rate differential.

A 3-day swap occurs when a position is held over the weekend, and the swap charge or credit is adjusted to cover three days of interest.

- Negative Swap

- Risky process

- Not suitable for all

- Subject to change

Understanding the concept of Swap in Forex trading

When a trader holds the position overnight, his position is rolled over the next day, which means the position is closed on the trading day, and the next day, it will be reopened.

In such cases, you have to pay, or you can earn interest on your trade. There will be positive or negative swaps in forex trading. The concept of swap interest rates is simple.

When the interest rate on the currency you buy is higher than the currency you sell, there will be a positive swap. When the interest rate on the currency you buy is lower than the currency you sell, there will be a negative swap.

Swap in Forex Example

Suppose you are trading in GBP/EUR pair, the interest rate of GBP is 4%, and EUR is 2%. In this example, the interest rate of the currency you are buying is more than the currency you are selling.

So, here is a positive swap rate of 2% a trader will get. In the same example, suppose the interest rate of GBP is 2% and EUR is 4%; then the trader has to pay negative swap of 2%.

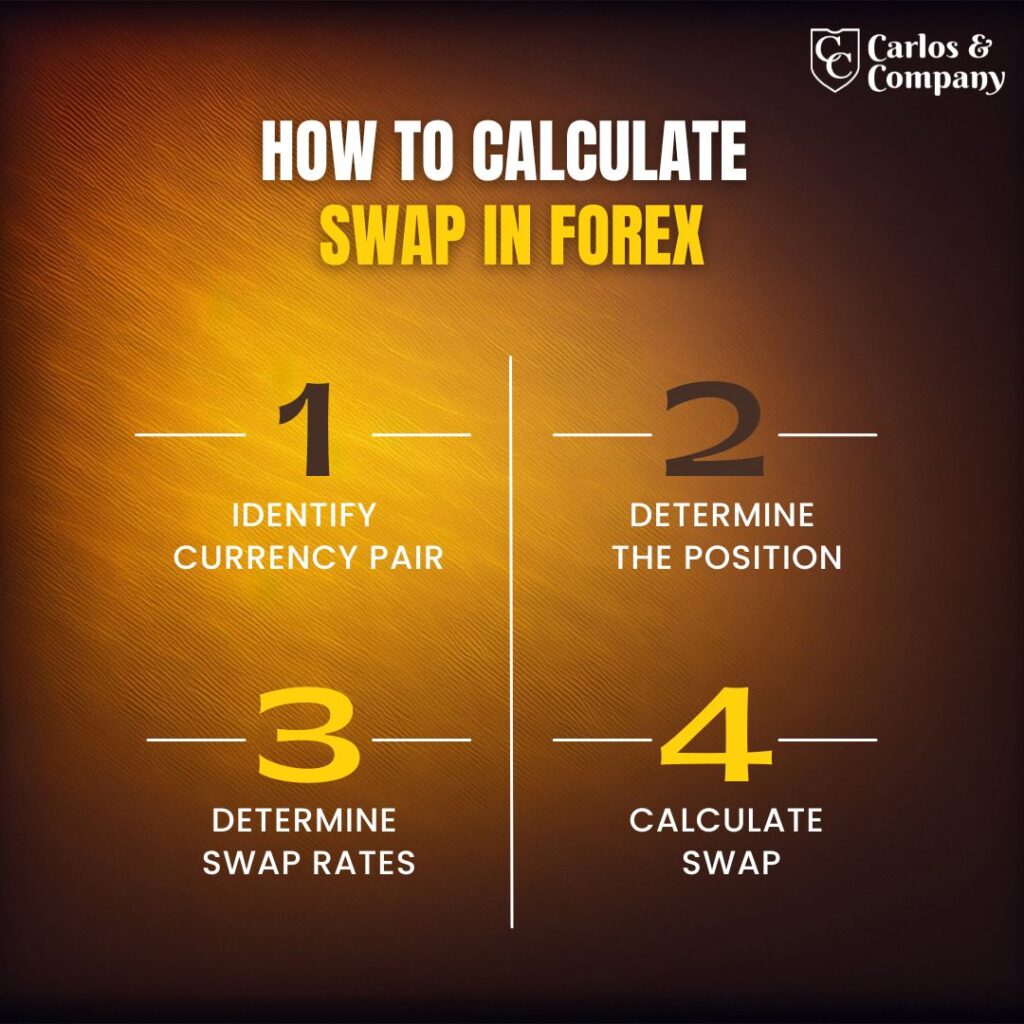

How to calculate swap in Forex

Calculating swaps is a very complex process, but not to worry. Here is a step-by-step procedure to calculate the swap.

Identify currency pair:

The first and foremost step is to identify the currency pair you want to trade. A currency pair is selected after watching many factors, including volatility, liquidity and risk factors. Let us take EUR/USD Pair.

Determine the position:

The next step is determining whether you want to go long or short, which means buying or selling the pair.

Also, determine the lot size of your trade; mini, micro and standard lot sizes are available for trade. Suppose a trader is buying 10,000 units of EUR/USD pairs.

Determine Swap rates:

Remember, swap rates depend on factors such as your forex broker, currency pair, market condition, etc. You can get these rates from their websites.

When you buy a currency pair, the long swap rate applies; when you sell a currency pair, the short swap rate applies. So trade accordingly.

Calculating swap:

In the last step for calculating swap, you just have to multiply the swap rate by lot size and divide the result by the pips.

In the above example, a trader buys a mini lot of EUR/USD. Suppose the current swap rate is -3.23 pips per day. The position size is one mini lot.

Swap amount = (Position size × Swap rate) ÷ Pip value

Swap amount = (1 × 3.23) ÷ 10

Swap amount = -0.323 USD.

In this case, a trader must pay 0.323 Dollars for holding a position every night.

Types of swap in Forex

Fixed for fixed rate:

When the interest rate of both the base and quote currency is fixed, the payment and earning of the swap interest amount are also fixed.

Fixed for floating rate:

When the interest rate of one currency is fixed, and the other is floating. Under this floating rate is determined periodically based on the forex market conditions.

Advantages of Swap in Forex

Extra earning:

One of the best parts about the swap in forex trading is you can earn money apart from trading through the interest rate. If the interest rate of the currency you are buying is higher than the other, you can earn interest.

Easy borrowing:

You can borrow money from any other country due to the Cross currency swap rate. Suppose an European wants a loan. However, the loan rate of EURO is very high.

In this case, he can borrow money from the USA or any other country with lower interest rates. A currency swap allows you to exchange principal and borrow the currencies at a lower rate.

Best for carry trades:

Another advantage of forex swap is it helps in the formulation of profitable carry trade strategies. Carry trade is borrowing currencies with lower interest rates and investing in currencies with higher interest rates.

You can determine the interest rate using swaps and make forex trading strategies accordingly to earn maximum profit.

Rollover:

One can extend the trade position using rollover; the trading method is also known as the ‘tomorrow-next day’ or ‘tom-next’ rate to prevent the delivery of currency.

Many traders want to hold a position overnight or beyond the trading day without closing the position at the end of the day. Using swaps in Forex, one can hold the position, and it will reopen on the next trading day.

Risk Management:

Many traders or organizations also use a currency swap to hedge the risk of exchange rate fluctuations in the forex market. Traders can monitor the swap rates to manage risk and formulate trade strategies.

Companies indulged in regular global transactions make opposite transactions. If they suffer loss from one, they can swap the profit from another.

Disadvantages of Swap in Forex

Negative Swap:

A trader has to pay for holding a position when the interest rate of the currency you are buying is lower than that you are selling.

In such cases, your profit will be affected, or if you have suffered a loss, you have to pay the swap interest rate from your pocket.

Risky process:

Holding a position overnight is not easy as it looks. With the potential profit, there are also channels of potential risk; as we all know, forex trading is affected by many factors.

One unexpected event may affect the overall profit. Also, generally, people trade in Forex when the trade volume is high. However, the trade volume beyond the trading day is comparatively less.

Not suitable for all:

Swap calculating is a complex process under which you must monitor the swap rates. The inaccuracy of data may affect the overall trade decision.

Also, market knowledge is required to determine the pips value of different pairs. So it is not suitable for beginners or traders with a lack of market understanding.

Subject to change:

Swap rates are frequently changed due to different fundamental analysis factors such as government and central bank policies, economic reports, etc.

Due to changes in market factors, your prediction may go wrong, and your overall profit may get affected. Also, different brokers offer different swap rates, which may affect your predictions.

Bottom Line

Swap in Forex helps traders in risk management, extra earning and hold their trade position overnight. However, it also has certain disadvantages.

Therefore for using a swap in currency trading, it is a must to have a right trading psychology & monitor the interest rates continuously. It will help you to predict the market and formulate profitable strategies.