What is Fundamental Analysis?

Market analysis plays an essential role in Trading to make the right decision. There are three major financial analysis types: fundamental, technical and sentimental. Fundamental analysis is a crucial process. Let us understand what is fundamental analysis before moving ahead.

Here's a quick look at what you'll read

Fundamental analysis is a technique for evaluating and interpreting the market. The main aim of fundamental analysis is to predict the market better to increase the chances of profit from the investment.

Forex’s fundamental analysis utilizes the three data groups to interpret the market. It includes:

- Historical Data

- Economic Data

- Current Affairs

- Qualitative analysis

- Quantitative analysis

- Gross Domestic

- Product (GDP)

- Consumer Price

- Index

- Inflation

- Disasters and Natural calamities

- Politics

Fundamental Analysis

Fundamental analysis is a technique for evaluating and interpreting the market. The main aim of this analysis is to predict the market better to increase the chances of profit from the investment.

The analysis integrates the financial statements, events, external influences and trends in the industry. This analysis technique is used in forex, stocks, crypto and other financial markets.

Under Fundamental analysis of the forex, detailed research is conducted to analyze the state of the forex market. Such research helps you determine a currency pair’s key features and analyses when to buy or sell it.

Fundamental analysis example

To understand what is fundamental analysis better, let us look its example. Suppose the USA has made a vaccine for an incurable disease. Many countries since years are working on a vaccine.

As a result, the USA will export the vaccine to all the other countries. It is positive news for the US economy. Hence it has a positive impact on its currency. So this is the best time to invest in US Dollars.

How to do a fundamental analysis

The fundamental analysis of forex utilizes the three groups of data to interpret the market and decide according to it.

1. Historical data:-This data studies how things stood in the past. Based on past movements, the prediction is made.

2. Economic Data- It includes economic reports, government statements, Central Bank Policies, import and export data, etc.

3. Current News: It includes all the current news that may directly or indirectly affect the forex market, such as political turmoil, government change, stock market report and other financial news.

Types of Forex Fundamental Analysis

There are two primary kinds of this method.

Qualitative analysis:

With the name, it is clear that this type of analysis will deal with quality analysis. It is a study that includes the value of currency pair, the living standard of a country, rules and regulations regarding trading and other matching aspects.

Quantitative analysis:

Quantitative analysis is based on numbers and figures. It takes historical data, statistics and performance into consideration.

Quantitative tools are complex numbers. They are the quantitative features of a currency because the most significant quantitative data is financial information. They can measure the revenue, profit, and assets more strictly. Also, they will help you to formulate the best strategy.

The qualitative analysis is less tangible. So, it involves the quality of the country’s industrial, financial, social and economic factors. Using both analysis techniques is important to get the desired result.

Tools of Fundamental Analysis

Now you have read what is fundamental analysis and how to do it. It’s time to study the tools of fundamental forex analysis that helps you in determining trading opportunities.

- Interest Rate

- Gross Domestic Product (GDP)

- Consumer Price Index

- Inflation

- News

- Economic Indicators

- Central Bank policies

- Disasters and Natural calamities

- Politics

- Industrial and technological development

Methods of Fundamental Study

There are two methods – One is top-to-down, and the other is a bottom-up procedure.

The top-down procedure examines the macroeconomic factors and then searches the particular currency. Conversely, the bottom-up procedure first studies the currency and then examines the impact of macroeconomic factors on the currency’s performance.

Though the methods differ, they are equally critical for a complete study of the currency’s value.

Advantages of Fundamental analysis

- Fundamental analysis helps in forecasting the long-term movements in the market.

- It also lets you discover good trading opportunities and the right time to invest in them.

- This analysis helps with one of the most crucial but intangible aspects, i.e., understanding how to trade, which is useful in studying investments as it can inform you about future currency.

- It helps the trader to make an unbiased, logical and accurate investment decisions.

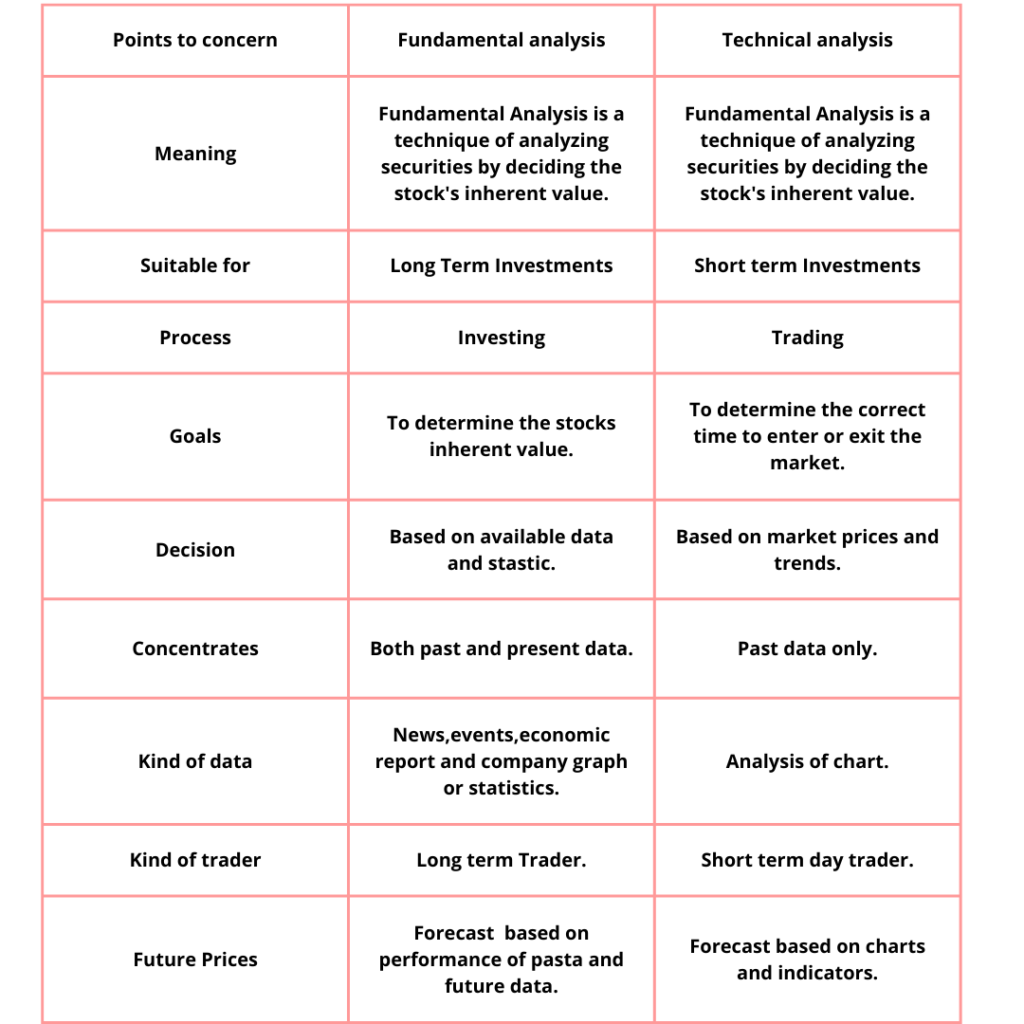

Fundamental analysis vs. technical analysis

Technical and fundamental analysis are concerned with using available information to forecast the behavior of the market in the future; they accomplish this in different methods.

When you perform the technical analysis, you only focus on the movement of price and data, pursuing trends and patterns that show the possible direction of the market future.

But on the other side, in fundamental analysis, you take a more holistic idea and evaluate all the market events. You may evaluate the health and welfare of an overall economy, industries and individual companies that structure the country and its currency value.

This study can involve setting all factors, from the country’s employment rates, expenditure, income and debts. The study is usually more rigid and complete than the technical one because everything can impact the value of assets and review, not only price data and chart patterns.