Can You Make Money From Forex Trading?

Before moving ahead with the answer, Can you make money from forex trading. Let’s have a quick overview of what the forex market is, its example, its mechanism and how it works.

Here's a quick look at what you'll read

The term “Forex” is a shortened blend word for “Foreign currency and exchange.” Thus, forex trading deals with converting one currency into another

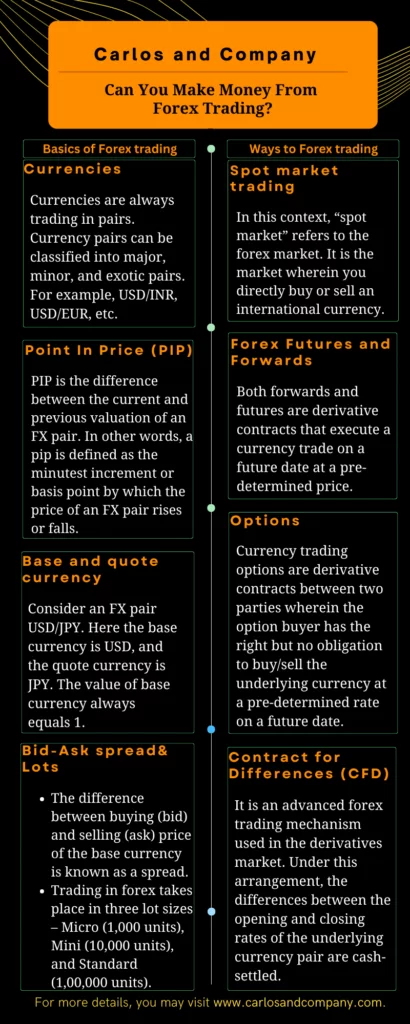

- Currencies

- Point In Price (PIP)

- Base and quote currency

- Bid-Ask spread

- Lots

- Spot market trading

- Forex Futures and Forwards

- Options

- Contract for Differences (CFD)

- Select a Broker

- Open an account

- Start with small trades

What is Forex?

The term “Forex” is a shortened blend word for “Foreign currency and exchange.” Thus, forex trading deals with converting one currency into another for myriad reasons like business, international trade & commerce, foreign travel & tourism, currency risk management, etc.

It is often referred to as “FX trading,” which involves the buying or selling a fiat currency pair. Fiat currencies are government-issued or sovereign currencies not backed by any asset.

Usually, investors engage in forex trading to mitigate the losses arising out of the devaluation of a currency vis-a-vis another currency. In other words, the currency purchased is expected to appreciate while the one sold is expected to depreciate.

You can also profit by seizing currency arbitrage opportunities from the exchange rate differential between two or more currencies.

How to Make Money from Forex Trading?

The forex market is decentralized for trading and exchanging different international currencies. It is a virtual OTC (Over-The-Counter) market where traders digitally transact with each other via computer networks.

The forex market is open 24 hours, Monday – Friday. The major international centers for forex trading are New York, London, Frankfurt, Tokyo, Hong Kong, Zurich, Singapore, Paris, and Sydney. Each session has different forex market hours for trading.

Forex markets enable retailers and organizations to exchange international currencies daily, especially for global trade and travel.

Forex trading example, suppose an Indian firm imports automobile spare parts from a German firm; the Indian firm has to incur the import cost in Euros (EUR).

Assume the total procurement cost is EUR 50,000. Thus, at the current EUR-INR exchange rate of Rs 88.33, the Indian importer has to forgo Rs 44,16,700 to get EUR 50,000 to pay the German exporter.

Similarly, individuals require international currencies whenever they travel abroad. For instance, suppose you are traveling to the US. INR won’t work there as the legal tender of the US is dollars(USD).

Thus, you need to convert INR into USD to manage your living expenses during your stay in the US.

From the investment perspective, the forex market enables you to diversify your portfolio and hedge currency risks.

Basics of Forex trading

Your forex trading profit will depend on your knowledge. Before you embark on the forex trading journey, you may acquaint yourself with some common forex trading terminologies.

These important terminologies help you learn the forex market thoroughly to understand and make money from forex trading.

Currencies

Currencies are always trading in pairs. Currency pairs can be classified into major, minor, and exotic pairs. As USD is the most popular global medium of exchange, major currency pairs will always involve USD. For example, USD/INR, USD/EUR, etc.

Minor pairs do not contain USD but other major global currencies. For example, GBP/JPY (British pound sterling/Japanese Yen), EUR/GBP, etc. Exotic pairs peg one major currency against a minor currency. For example, AUD/MXN (Australian Dollar/Mexican Peso) etc.

Point In Price (PIP)

PIP is the difference between the current and previous valuation of an FX pair. In other words, a pip is defined as the minutest increment or basis point by which the price of an FX pair rises or falls.

For example, if the exchange rate between GBP/USD is 1.3864 and 1.3934 today and yesterday, respectively, then the PIP is 0.007. The current FX rate is lower than the previous, implying that the USD has depreciated vis-a-vis GBP.

Base and quote currency

Consider an FX pair USD/JPY. Here the base currency is USD, and the quote currency is JPY. The value of base currency always equals 1.

The FX rate is always expressed as the amount of quote currency required to purchase 1 unit of the base currency.

Bid-Ask spread

The difference between buying (bid) and selling (ask) price of the base currency is known as a spread.

Lots

Trading in forex takes place in three lot sizes – Micro (1,000 units), Mini (10,000 units), and Standard (1,00,000 units).

Different ways to make money from Forex trading

Spot market trading

In this context, “spot market” refers to the forex market. It is the market wherein you directly buy or sell an international currency.

For instance, when you go long on USD/INR, it means you have bought USD by selling INR. Conversely, going short on USD/GBP implies that you sold USD for purchasing GBP.

The spot or exchange rate is determined based on various factors like current & forecasted global economic conditions, demand & supply for a currency, overall investor sentiment towards a currency, import-export volumes, etc.

In spot trading, one party delivers to the counterparty a stipulated amount in a specific currency in exchange for an equivalent amount in another. Spot trades are usually settled in cash on a T+2 basis. It is also the best way by which you can make money from forex trading.

Forex Futures and Forwards

Both forwards and futures are derivative contracts that execute a currency trade on a future date at a pre-determined price. However, forwards are private deals between two parties executed in decentralized OTC markets.

On the other hand, currency futures are standardized contracts executed at organized exchanges. Hence, the exchange is a counterparty to every trader. Consequently, forwards carry a higher default risk than futures.

The prime difference between currency spot and derivative trades is that derivative contracts do not involve physical currencies. They just specify claims to the underlying currencies by the contracted parties.

Forwards and futures are good currency risk-hedging mechanisms. They help you lock in a specific exchange rate for the future, especially when currency rates fluctuate rapidly.

Options

Currency trading options are derivative contracts between two parties wherein the option buyer has the right but no obligation to buy/sell the underlying currency at a pre-determined rate on a future date.

Options also help in currency risk hedging. Besides, they are standardized, cash-settled agreements executed on organized exchanges.

Contract for Differences (CFD)

It is an advanced forex trading mechanism used in the derivatives market. Under this arrangement, the differences between the opening and closing rates of the underlying currency pair are cash-settled.

You can trade on margin, go long if you are bullish, or go short if you are bearish. It is a leveraged instrument. Hence, you must pay an upfront deposit that is a small percentage of the total transaction value.

This way, you can take large positions in the forex market with less money in your kitty. It helps you benefit from the bidirectional movement of exchange rates. However, the magnitude of gains, as well as losses, is high with this strategy.

How to trade in forex

Investing in foreign stocks or indices, international bonds, or mutual funds with international equity exposure, etc., are easy ways for retail investors to enter the forex market.

However, before investing in these financial instruments, you need to follow a proper trading procedure. Here is a step-by-step Forex trading guide for retail investors.

- Selecting a Broker: First and foremost, you need to find an authorized broker who facilitates online forex trades. You may also check the commission, brokerage, and other transaction charges levied by the broker.

The more competitive the pricing structure, the lower will be your forex trading fees and, consequently, higher profits.

- Open an account: The second step is to open a Demat and trading account with the selected broker. Once the requisite formalities are completed, you may start forex trading.

- Start with small trades: The next step would be to carry out trade simulations or invest small amounts. Once you gain significant expertise, you may trade with bigger amounts.

As a novice, you may refrain from excessive leverage, learn from your failures, and avoid impulsive decisions. Knowledge of fundamental and technical analysis will come in handy while selecting foreign securities for investing.

Moreover, you may master simple investment strategies before practicing complex trading strategies like margin and derivative trades or investing in complex derivative instruments like currency swaps, swaptions, etc.

Conclusion

Forex trading has good wealth generation potential. It is also a good avenue for risk hedging and portfolio diversification. However, like any other trade, the magnitude of gains and losses is also high in forex trading.

Hence, you may trade cautiously, especially if you are a beginner. But, with focus, patience, practice, endurance, and right trading psychology, you can make money from foreign currency trading. The amount of your profit depends on your investment capital and risk factor.