What is backtest in trading?

What is backtest in trading & how to backtest your trading plan?

In the forex market, traders can lose and earn tons of money because of their strategy. So it is very important to analyze your plan’s effectiveness and success rate. In this article, you will learn about what backtest is in trading and its importance for staying profitable.

Here's a quick look at what you'll read

Backtesting is a process of evaluating the performance of a trading strategy or system using historical data or price patterns.

Meta Trader 4, Meta Trader 5, Ninja Trader, TradeStation, MultiCharts, AmiBroker, etc., are popular trading platforms that provide backtesting services.

- Quick and Logical Results

- Risk Management & Performance Analysis

- Develop Market Understanding

- Optimization & Comparison

- No Guaranteed Return

- Technical Knowledge

- Data inefficiency

- Lack of Adaptability

Forward testing is used to test the strategy against the currency market conditions or real-time data & backtesting tests the strategy against historical price movements.

What is backtesting?

Backtesting is a process of evaluating, testing, and analyzing the performance of a trading strategy or system using historical data or price patterns.

The main aim of this method is to identify the weakness or strengths of a trading plan using different tools and make changes accordingly. The technique is widely used in different fields, including businesses, finance & trading.

Importance of Backtest in Forex

As we have studied, a well-organized backtest will help you check and adjust your plan, so it plays a crucial role in forex trading. The buying and selling of currencies take place based on predictions.

A trader uses different strategies to make money in a volatile currency market. However, the ineffectiveness of a trading plan may result in heavy losses. That’s where you need to backtest your trading strategy.

Trading in currencies is affected by many fundamental and technical analysis factors. Using forex backtesting, one can evaluate the plan and decide whether to go for it based on the success rate.

Types of Backtesting

Manual Backtesting:

As the name suggests, the trading strategy is tested manually under this process. Based on traders’ judgment & experience, the results are derived.

Automated Backtesting:

This method uses computer programs or algorithms software to test the strategy against historical price patterns. This system can process large numbers of data that too in very less time. Plus, the method is fully automated, so it eliminates human biases.

How to Conduct Backtest in Trading

Historical Data Collection:

The first step is to select the currency pairs you are trading to test against all the relevant historical data.

Remember, you have to determine when, where, why, and how you will place a trade. Also, consider the effectiveness, accuracy, and reliability of data and sources you have collected it from; otherwise, it will affect the whole process.

Select a trading platform:

Many trading platforms allow backtesting strategies. This platform provides paid and free Backtesting software and tools. However, select an authentic and reputable platform with good reviews.

Meta Trader 4, Meta Trader 5, Ninja Trader, TradeStation, MultiCharts, AmiBroker, etc., are popular trading platforms that provide user-friendly backtesting software to test your plan.

Strategy Set up:

Once you have selected the trading platform, it’s time to set up your strategy based on the software. Define the entry, exit, stop loss, take profit, support and resistance level, and all other pivot points.

You have to define your risk-reward ratio, leverage ratio, time frame, strategy, and other aspects. After defining this information, code your trading strategy on the platform.

Test your strategy:

Once you have provided all the information, it’s time to test it. Fill the relevant information and, using automated trading software, check the result.

The software will provide you with information, including the success rate, failure rate, effectiveness of the risk-reward ratio, expected profit or loss, etc. Also, test the strategy against current sentimental and fundamental analysis factors.

Analysis and Evaluation:

Analyze the backtesting results; if the results are ideal in all the parameters, then you can go for the strategy, and if they are not statistically significant, then make changes accordingly.

After overall analysis, if you find your strategy matches the test standard, then accept or reject the strategy. Now you can use trade strategies to buy and sell currency pairs.

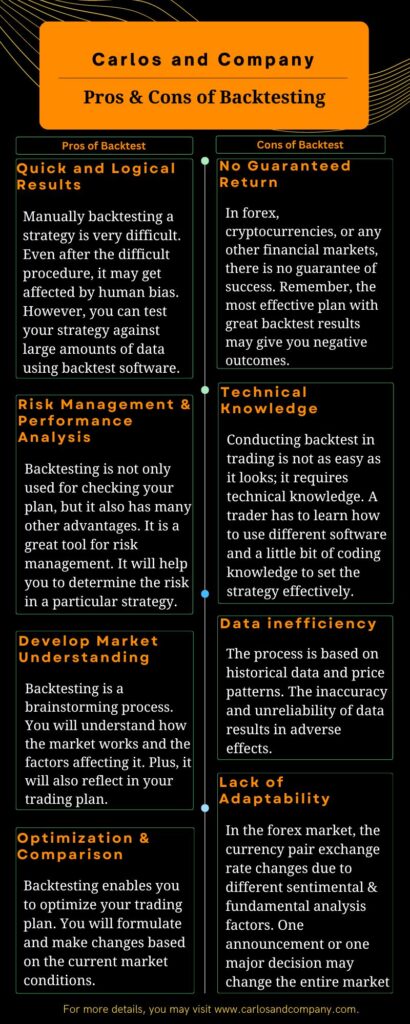

Pros & Cons of Backtesting

You have to understand the importance of backtest in trading. However, before using the method, you have first take a look at the benefits and limitations of it. It will help you determine whether it will be a good fit for you.

Pros of Backtest

Quick and Logical Results:

Manually backtesting a strategy is very difficult. Even after the difficult procedure, it may get affected by human bias. However, you can test your strategy against large amounts of data using backtest software.

In addition to logical results, the process is quick. You can get the outcome of the trade in a few minutes. So it will help you make trade decisions instantly and place trades on time.

Risk Management & Performance Analysis:

Backtesting is not only used for checking your plan, but it also has many other advantages. It is a great tool for risk management. It will help you to determine the risk in a particular strategy. Based on this traders can identify whether they can afford to tackle that amount of risk.

Also, it will help you to get an overall performance analysis of the plan. You can determine the win & failure rate, expected profit or loss, and other crucial details.

Develop Market Understanding:

Backtesting is a brainstorming process. You will understand how the market works and the factors affecting it. Plus, it will also reflect in your trading plan. You will develop a practical understanding of volatility, liquidity, and other forex market terms.

Optimization & Comparison:

Backtesting enables you to optimize your trading plan. You will formulate and make changes based on the current market conditions. Also, you can compare the strategy and use the most robust approach.

Cons of Backtest

No Guaranteed Return:

In forex, cryptocurrencies, or any other financial markets, there is no guarantee of success. Remember, the most effective plan with great backtest results may give you negative outcomes.

So backtesting is not a guarantee for success. However, it may decrease the chance of losing money. You are putting your hard-earned money in the market, so it is better to try and test the results.

Technical Knowledge:

Conducting backtest in trading is not as easy as it looks; it requires technical knowledge. A trader has to learn how to use different software and a little bit of coding knowledge to set the strategy effectively.

Remember, one missed punctuation may have adverse results. Also, experience is important for backtesting. Beginners or traders lacking market understanding may find the strategy very complex.

Data inefficiency:

The process is based on historical data and price patterns. The inaccuracy and unreliability of data results in adverse effects.

Also, the result may be affected by confirmation bias which means the popular belief of traders. However, these are not always true and may have severe effects.

Lack of Adaptability:

In the forex market, the currency pair exchange rate changes due to different sentimental and fundamental analysis factors. One announcement or one major decision may change the entire market.

However, backtest lacks in adapting to market conditions. Also, it considers that trades will execute at the desired price without considering liquidity and slippage.

Backtest vs. Forward Testing

Both backtesting and Forward testing are used to analyze the performance and optimize the trading strategies. However, the major difference is the usage of data on price movements.

Forward testing is also known as paper trading or demo trading. It tests the strategy against the currency market conditions or real-time data. The strategy is usually tested on paper and not on the trading platform. However, the strategy is tested against the historical price movements or data using trading platforms in backtesting.

Both strategies are useful; however, forward testing is more accurate due to reliance on current conditions. While regarding risk, backtest is risk-free, but forward testing carries the risk of losing the capital.

Wrapping up

We understood the concept and all important aspects of backtesting in financial trading. Using Backtest in trading enables you to stand out from the crowd and stay consistently profitable. The success of your trade depends on your plan, so it is essential to analyze it before using it in trading.

However, the effectiveness of any method depends on how it is implemented. That’s why it is very important to use it in the right manner. You can also take expert advice or use demo accounts to practically understand the process with significant Backtesting examples.